Malaysia Medical Insurance Professional and Technical Training Program, MMI Medical Insurance Training Program, Malaysia Health and Accident Insurance Training Program, Malaysia Medical Protection Insurance Training Program

Malaysia Medical Insurance Organization (MMI)

Course summary

Course summary

This MMI Medical Insurance Professional and Technical Training Program (MIPT) focuses on developing future Malaysia Medical Insurance Organisation (MMI) associate members or medical insurance advisors with soft and hard skills and competencies to deal with the constantly changing medical insurance business environment.

This "MIPT" programme equips MMI associate members with multidisciplinary knowledge and perspectives and develops their ability to lead flexible, responsive, responsible, efficient and effective organisations in the era of globalization.

The strength of this "MIPT" programme is the embedment of the elements of experiential learning into the teaching and learning process by extensive use of case studies and engagement of corporate leaders.

This "MIPT" program is designed in such a manner so that participants who go through the program will be able to perform the following: integrate and apply advanced business knowledge and skills in marketing and services; apply technical and practical skills toward the accomplishment of business objectives and goals; exercise analytical ability and apply social considerations when making planing and marketing decisions; communicate effectively, with different customers; develop social skills and demonstrate social responsibilities when working in a team; demonstrate professionalism and compliance to ethical standards in executing accountabilities and responsibilities; create lifelong learning culture by using information and communication technology to keep abreast with the changing medical insurance business environment; exhibit managerial and entrepreneurial skills for effective decision making and portray leadership qualities in managing a business strategically.

For the past three decades, our achievement in the education sector, we believe in developing people and transforming life using some of the most effective methodologies and techniques in experiential education program. We assist every individual and corporation to improve their performance in this challenging world.

Come and unleash your potential with our experiential MMI outdoor education program. Our proven learning methodology has helped our MMI associate members achieving their desired personal and corporate objectives.

| GENERAL INSURANCE TRAINING (Arranged by The Malaysia Insurance Institute - MII) |

MII will advise you or your contact person on the status of the MII training programme upon receipt of your completed registration form. Please ensure that you have received MMI confirmation advice before making any logistic arrangement such as accommodation and flight bookings.

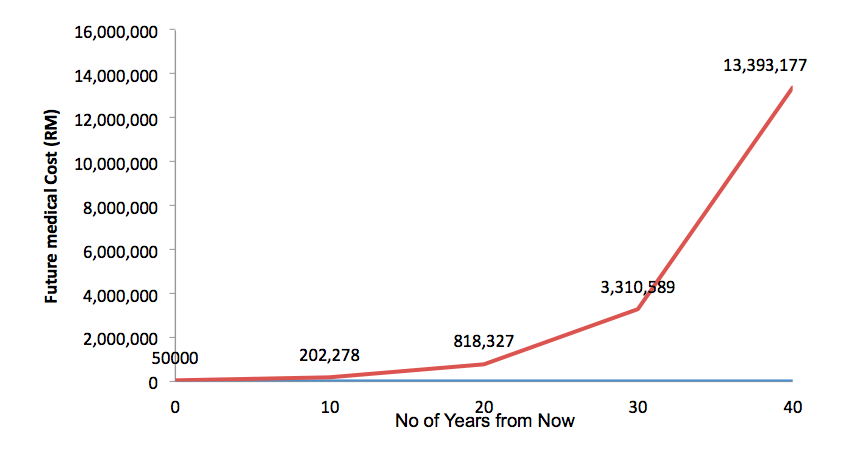

Have you ever experienced being admitted to a hospital because of your illness and your eyes bulge when you see the expensive medical bills that you have to pay for and you don’t have enough money to pay it? There is a saying that when we are young, we work too hard and trade our time and health for money. Then when we are old, we trade our money to hopefully gain back some health.

This is so true because there are so many old folks who save hard and put the money in the bank but the interest earned is barely enough to cover the medical cost inflation.

Nowadays, many people had realized the high cost of being hospitalized. When medical fees keep escalating, more people are aware and seek for medical insurance coverage. So the first step towards cutting medical expenses is to get insured, while you are still qualified to apply for total coverage.

1.Get insured with Hospitalization & Surgical benefit

I explained about medical insurance before. Refer the video for a very simple and easy to comprehend presentation.

Utmost, personal health should be one’s top most priority. You can’t go to work if you are having a high fever, right? Because if you do, you won’t be that productive compared if you are on your normal state.

In the past, I’ve met several MLM or direct salespersons who normally sell all kind of health product. Once they know that I’m an insurance agent, they almost always pitch the idea that when you eat healthily and take good care of your body, you’ll never get sick. Therefore, there is no need to buy medical insurance.

This statement may have some truth in it although some insurance agents may get offended by the whole idea of stay healthy and throw away your "medical card”. So the second obvious tips on cutting medical bills is to live a healthy lifestyle!

2.Eat organic food, workout regularly, and take care of your personal hygiene and your home’s cleanliness to have a healthy lifestyle, therefore a healthy body.

However, if you are too late to get insured, or your health is already depleted in some way, don’t be panic. There are still more tips coming up that may save your hospital bills. Just in case you are hospitalized (touch wood) due to unforeseen circumstances, here are more tips that could get you going.

3. Have your previous test report ready and decline other unnecessary "add-on”

First things first, for you to lessen the cost of your medical bills, you have to have your updated previous test results for your health with you. If the test was taken days ago, then you could bring that when you want to be admitted on a hospital. These previous results that you have could lessen your cost since you will not take some tests because they are going to refer the results on what you have. But bear in mind that not all previous results is helpful when you want to cut costs. Some tests need to be taken anew to provide you progress or update on your current health and for them to find out if there is anything wrong with your present health.

Another thing to remember when you want to prevent necessary costs is that, when you have a hospital room, you can always decline offers of having a television set on your room or a fridge there to be put, or any additional appliance or room ornaments that add up to your costs. By doing these things, you can start saving your costs though it may seem to be small but at least you started it.

If you have already chosen a hospital room for you to be in and you have already taken the necessary tests for you, having the right doctor and being admitted on a good time is the next thing that you need to consider.

4. Consult a practitioner rather than a specialist

We cannot predict when or where we are going to get sick. We always have to take good care of ourselves for us to avoid being in the hospital for any extensive treatment and for us to avoid any expensive hospital costs. But there really is a time that you can’t stand the pain or illness that you have and you really need to go to a hospital for treatment. In finding a doctor, for you to cut costs, you can consult a general practitioner rather than a specialist. Why? It’s because general practitioners are more affordable than those specialists. Payments for specialists for consultations are half more expensive than that of general practitioners. See how much you can already save when you meet for a doctor?

But you should always go to the general practitioners that you trust. If not, sometimes you may end up paying even more when your first visit is not fruitful. You may still need to visit the specialist later.

Another thing that you can keep in mind is the time that you are admitted. There are certain times in the calendar that medical costs would raise and you would have to pay an expensive bill. But you don’t always have to keep the pain in and wait until the time that costs are cheaper. It is your health still and you should always take care of it.

5. Always request for the itemized billing statement

Be clever. Since you want to invest more on your health, you have to know everything that you pay for in the hospital. That is why you need to request the hospital to provide you detailed information on your medical bill. From the cotton ball that was used down to the drug that was administered, everything in the hospital is paid.

As a clever and knowledgeable customer, since a hospital is a service and at the same time a business, know what you really are paying for. Though mistakes unusually happen on the breakdown of your medical bills, still, you can always double check it.

6. Ask for discount – from doctors and also from hospitals

Another good tip that you can adhere to if you want to save on your medical bills, is that you can ask for discounts. Hospitals could give you discounts but not all people can truly avail of this kind of service that they provide. It would now be based on the situation that you are in, in terms of the financial aspect.

For you to be able to have this discount, the hospital may ask you to procure any proof of your salary so that they could estimate if your income is suitable for a discount or not. It is all based on the income that you have. If you have a fairly low income, the hospital could grant you the discount or another way for you to pay is by installment. Meaning, you will pay a percentage of the total amount of the hospital bill for the meantime for you to be released and you will pay the remainder of the amount on the latter, depending on the agreement that the hospital provided you to abide for.

If the hospital cannot provide you with a discount then you can always ask for the approximated amount that you need to pay for the entire duration of the treatment. This is usually done by customers who have a tight budget for and they could allot money for the medical bills since they already know how much it would cost. You can always ask for how much it would cost all-in-all even if the treatment hasn’t started yet.

Beside asking discount from the financial department or billing department of the hospitals, you can also ask for discount from the doctors who treat you. Get enough sympathy, and the doctor will write off some consultation fees, or procedure charge.

7. There are cheaper options of generic drug.

If your intention is to have a good health and keep your pockets intact, then you can consider this next tip. When choosing the medications that you need to buy, you can always find out choices from generic medications. These kinds of drugs in terms of cost may be cheaper compared to those branded drugs which go half or three quarters more expensive than that of generic drugs.

Also, you need to know that the payment that you pay for those branded drugs may include the branding cost of the company. Generic drugs may have the same quality as to patented drugs in terms of the effects of the medicine. It is usually similar in terms of the pharmaceutical components of both. Another one is in terms of its potency and effectiveness as a drug, though generic ones are cheaper in costs, some of them still give you the same effects like that of those branded ones.

If you can find generic and cheaper drugs instead of patented ones, you may save lots of money and at the same time, cure yourself of the illness that you have. Anyway, you shouldn’t be mislead that all generic drugs are as good as the "branded” drugs.

8. Get help from your employer.

If you are working in a company, you can always have them to help you shoulder some of the bills for your hospitalization, especially if the injury or the incident that happened to you is work-related.

Companies nowadays, offer their employees and potential employees health benefits. Since the industry of commerce puts you into stress you might consider your company helping you for your bills.

Some companies provide free annual checkups and other tests like physical tests, reproductive tests, and drug tests. Also, companies now offer extended medical services for your children or your other halves. Be wise to know what your company offers you so that you could have an advantage in taking care of your medical budget and your health as well. Ask your manager or go to the HR officer to find out about the medical terms and coverage that your office could help you to.

Health is very important for us. By following the tips mentioned, you can now be wise enough and be resourceful for in order to not only save on our medical bills but at the same time, have a healthy and productive life.

|

• A compulsory entry requirement for all those who intend to be registered as insurance agents

Syllabus details:- MEDICAL and HEALTH INSURANCE Withdrawal

If a certificate is defaced, lost or destroyed, it may be replaced upon a written declaration witnessed by a Commissioner for Oaths and stamped. The declaration is to be submitted to the Institute together with a certificate fee of RM15 (Ringgit Fifteen) before a new certificate can be issued. Every certificate issued or made by the Institute shall, not withstanding the payment of any fees and subscription, remain the property of the Institute and shall be returned by the recipient on demand thereof by the Institute. Examination Format and Structure

Language The examination will normally be conducted in Bahasa Malaysia, English, Mandarin and Tamil. Candidates may register for the examination in any one of the languages offered at each examination. Change of Examination Centres, Routes and Languages

Applicants seeking exemption should apply to MII in writing, submitting certified copies of relevent certificate(s) and other documentary evidence of qualification together with a processing fee of RM20.00 payable to the MII.

Breach of Examination Regulations The decisions of the Board and/or the empowered authority shall be final and binding. Liability of the Institute

Candidates must produce this Examination Entry Permit together with their identity card at the examination hall. Failure to do so will bar the candidate from the examination. Late Entry Examination

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No. 55, Jalan 3/93, Taman Miharja, Jalan Cheras,

55200 Kuala Lumpur, Malaysia.

General Fax: +603-9281 1435 / +603-9287 2855

Fellow Certified Life Practitioner (FCLP) Designation

LP101

Personal Insurance: Principles & Marketing

- Overview of Course: Financial Planning and Personal Insurance

- Concepts and Purpose of Financial Planning, Life Insurance & Life Insurance Selling as a Career

- Life Insurance Industry, Organizations and the Changing Financial Landscape

- Overview of the Sales Cycle & Personal Traits of a Successful? Insurance-Based Financial Planner

- Prospecting & Targeting Marketing & Pre - approach & Life Insurance Products

- Approach & Life Insurance Law & First Interview & Savings and Investment & Fact-finding & Single Need and Total Needs Approach

- Analyzing the Case & Methods of Analysis

- Presentation/Closing & Effective Closing Techniques

- Underwriting the Case & Information Technology and the Agent

- Unit Trust, Investment of Life Insurance Companies and Investment Products & Integrated Sales System and Hall marks of Professionalism of a Financial Services Professional

Durations = Moderating based – 15 weekly sessions of 2.5 hours each

LP102

Business Insurance: Principles & Marketing

- Introduction to Business Insurance as a Financial Planning Tool for Financial Services Professionals

- Overview of Business Organizations

- Developing Your Business Insurance Market

- Sole Proprietorship & Pre-approaching Business Prospects

- Partnership & Approaching Business Prospects

- Companies & the First Interview

- Business Continuation

- Liquidation of Businesses & Business fact-finding

- Liquidation of Business & Analyzing Business Cases

- Buy-Sell Insurance, Presentation and Closing Skills

- Key man Insurance & Group Insurance Schemes, Payroll Deduction? Plans & Underwriting Business Insurance Cases

- Analyzing Financial Statements and Post-Sales Service

- Approved Retirement Schemes and Tax Planning for the Business Prospects & Strategy for the Business Market

Durations = Moderating based – 15 weekly sessions of 2.5 hours each

LP103

Associated Legal Principles in Life Insurance

- The Legal System & Law of Contract

- Utmost Good Faith & Insurable Interest

- Payment of Policy Moneys

- Life Insurance and Trusts

- Application of Life Insurance Trusts

- Assignments & Law of Agency

- Policy Conditions and the 1996 Act

- Understanding the Insurance Act 1996

- Legal Issues Affecting Title

Durations = Lecture based – 4 full days of 6.5 hours per day

LP104

Business Risk & Continuation Planning

- Business Succession Planning for SME Owners

- Business Liquidation and Succession Planning

- The Succession Planning Process

- Closely-held Small and Medium-Sized Enterprises (SME)

- Important Qualitative Characteristics of SME that Require Planning

- Disadvantages of SME

- The Succession Problems of Each Type of SME Business

- The Financial and Legal Consequences When a SME Owner Dies

- Retirement, Disability and Critical Illness Business Buyout Arrangements

- The Insured Buy-Sell Agreement as a Solution to SME Succession Problems

- Business Valuation for SME Businesses

- Business Succession Case Studies

Durations = Lecture based – 4 full days of 6.5 hours per day

Chartered Agency & Practice Manager (ChAPM) Designation

Module 301 General Management Principles & Practices

Module 302 Agency & Practice Management

Module 303 Commercial Law & Financial Advisory Regulations

Module 304 Corporate Governance & Directors Duties

Module 305 CRM in Financial Advisory Business

Module 301

General Management Principles & Practices

- General Management Skills

- The Job Of The Manager

- The Manager & The Organization

- Delegation For Results

- Motivation To Higher Productivity

- Effective Communication

- Selection Of Quality Staff

- Appraisal Performance

- Training For Improvement & Counseling For Results

Module 302

Agency & Practice Management

- The front life of Life insurance/Financial Planning Practice

- Insurance sector and Agency Management

- Business Orientation in Life Insurance & Financial Services

- Financial Sense and response

- Leadership & Team Building

- The Job of Sales Manager

Module 303

Commercial Law & Financial Advisory Regulations

- The Malaysian Legal System

- Law of Contract

- Agency Law and Partnership

- Financial Services & The Law

Module 304

Corporate Governance & Directors Duties

- Corporate Governance in Malaysia

- Corporate Governance Defined

- History of Company Laws and Practices

- Interest in Corporate Governance & Corporate Governance

- Provisions for Corporate Governance in Companies Act, 1965

- Effective Audit Committee

- Malaysian Institute of Corporate Governance (MICG)

- Malaysian Code on Corporate Governance

- Minority Shareholders Watchdog group (MSWG)

Module 305

CRM in Financial Advisory Business

- Relationship Dynamics Roles in the Financial Advisory Business

- Terminologies in:-

- Financial Advisory Business

- Investment Advisory Business

- Financial Planning Business

- Customer Relationship Management

- Understanding the "Know Your client” rule

Chartered Investment & Finance Practitioner (ChIFP) Designation

IF401 Valuation of Securities & Fundamental Analysis

IF402 Portfolio & Fund Management

IF403 Managerial Finance & Investment Planning

IF404 Regulatory Controls on Investment Advisors

IF401

Valuation of Securities & Fundamental Analysis

Objectives

- The importance and relevance of financial statements in financial and investment analysis

- Brief introduction on how accounting standards and policies are generated in Malaysia. The regulatory bodies that affect accounting rules and presentation to the public in respect of contents and timing of releases are recognized

- The role of external outlook in international market, domestic economic market, industrial sector business life cycle, market share, goodwill and managerial skills in are studied in addition to financial statement analysis

- Discuss the limitations of the use of financial statements and related important accounting issues when interpreting financial statements for informed investment decision making

- Definition and valuation of fixed income and equity securities. Concepts of time value of money in pricing and the valuation of securities. Application of the concepts in financial and investment planning

IF402

Portfolio & Fund Management

The major learning objectives are listed below. Upon completion, participants are expected to be able to perform the following:

- Briefly describe a range of investment concepts which are commonly used by most fund managers

- Possess the ability to communicate the financial planning approach necessary to meet the financial goals of their clients

- Present and outline portfolio management process adopted by institutional investors

- Define and describe the major asset classes and their specific features in meeting Investment objectives

- Have a reasonably good grasp on basic portfolio theory principles. Understand the concept of risk management and the trade-off between risk and return in funds management

- Indentify the investment strategies available to fund management with respect to management of equities portfolio, debt portfolio, property portfolio, portfolio of international assets and portfolio of non-traditional assets

- Describe the principles of measuring and evaluating fund managers’ performance.

- The established criteria for selection of fund managers are outlined

IF403

Managerial Finance & Investment Planning

Objectives

- Introduction to financial markets and the investment environment in Malaysia

- Brief introduction of economic fundamentals and the impact of their changes on investment.

- Outline the inter-relationship amongst corporate finance, investment and strategic management

- Application of financial statement analysis in selection of securities and derivatives products.

- Concept and computation of EVA and its implication in investment decision with the objective of maximizing shareholders’ wealth

- Understand the application of time value of money and opportunity cost of capital in investment decision

- Measurement of risk and returns and their implication in portfolio selection

- Description on the process of portfolio management and usage of various benchmarks in evaluation of performance of funds managers

IF404

Regulatory Controls on Investment Advisors

Objectives

- Define the basic concepts and the principles of contract law and relevant issues

- Outline the application of Malaysian laws in the investment advisory services

- Describe the licensing requirements of investment advisers and investment representatives in Malaysia

- Specify the guidelines, characteristics and prohibitions of investment advisory activities

- Comprehension of the policies, guidelines and regulations governing issuance and offer of securities by Securities Commission

- Understand the characteristics and regulations with respect to acquisitions and takeovers in Malaysia

- Illustrate the guidelines and the regulations governing asset valuations by corporations for consideration by Securities Commission

Fellow Chartered Financial Practitioner (FChFP) Designation - Conversion Programme

Module Corporate Finance

Module Practice Management

Module : Corporate Finance

- The Role and Environment of Managerial Finance

- Risk and return

- Interest Rates and Bond Valuation

- Stock Valuation

- Capital Budgeting Techniques

- The Cost of Capital

- Leverage and Capital Structure

- Working Capital and Current Assets Management

Module : Practice Management

- The Frontier of Financial Planning Practice

- The Profession of Financial Planning

- Building the In-House Team and Forming

- The Organizational Structure of a Financial Planning Practice

- Composing the Practice’s Business Plan

- Marketing the Practice

- Client Building Strategies

- What is CRM?

- Setting Customer-Centered Strategies

How to Choose a Financial Planner

Choosing a financial planner may be one of the most important decisions you make for yourself and your loved ones. Financial planners can provide you and your family with guidance over your lifetime, or work with you to address specific concerns as needed. Whether you are struggling to manage your household finances more effectively, save for your children college education, or provide for your retirement, you may benefit from the services of a financial planner.Regardless of how you choose to work together, a planner can play a central role in helping you meet your life goals and achieve financial well-being. Consequently, take the time to select a financial planner who is competent and trustworthy, one on whom you can depend for professional advice and services.

Generally, financial planners have broad knowledge in such areas as insurance planning, investment planning, retirement planning and education planning. They also can possess a wide variety of designations, such as Certified Financial Planner (CFP).

Effective January 5, 2004, all financial planners in Malaysia are required by the Securities Commission to be licensed, and must have the recognised qualifications - Certified Financial Planner (CFP) being one of them.

The key to selecting the right financial planner is to consider their experience and credentials.

Certified Financial Planner (CFP)

Mark of QualityCFP practitioners have taken the extra step to demonstrate their professionalism by voluntarily submitting to the rigorous CFP certification process. In addition to significant education and experience requirements, they must pass a comprehensive exam that tests their personal financial planning knowledge and skills, continually update their abilities and abide by CFP Board's Code of Ethics and Professional Responsibility (Code of Ethics) and Financial Planning Practice Standards (Practice Standards).

When you work with a CFP practitioner, you are the focus of the financial planning relationship and your needs drive the financial planner's recommendations. As a client, you can choose from a wide variety of planners and planning services.

Tested For Competency

When selecting a financial planner, you need to feel confident that the person you choose to help you plan for your future is competent and ethical. To earn the right to use the CFP marks, individuals must complete the following competency requirements.

Education

Develop theoretical and practical financial planning knowledge by completing a comprehensive course of study at an approved college offering a financial planning curriculum developed by CFP Board of Standard in collaboration with Financial Planning Association of Malaysia (FPAM).

Examination

Pass a comprehensive CFP Certification Examination that tests their ability to apply financial planning knowledge in an integrated format. Based on regularly updated research of what financial planners do, CFP Board's exam covers the financial planning process, tax planning, employee benefits and retirement planning, estate planning, investment management and insurance.

Experience

Have a minimum of three years of experience in the financial planning process prior to earning the right to use the CFP marks. As a result, CFP practitioners possess financial counseling skills in addition to financial planning knowledge.

Committed to Ethical Conduct

Ethics

As a final step to certification, CFP practitioners agree to abide by a strict code of professional conduct, known as CFP Board's Code of Ethics and Professional Responsibility, that sets forth their ethical responsibilities to the public, to clients and to employers.

Through the Code of Ethics, CFP practitioners agree to act fairly and diligently when providing you with financial planning advice and services, always putting your interests first. The Code of Ethics states that CFP practitioners are to act with integrity, offering you professional services that are objective and based on your needs. They are required to provide you with information about their sources of compensation and conflicts of interest in writing, and must keep personal details obtained while working with you confidential.

Re-Certified Every Two Years

Once certified, CFP practitioners are required to maintain technical competence and fulfill ethical obligations. Every two years, they must complete a minimum of 30 hours of continuing education, staying current with developments in the financial planning profession to better serve their clients. Two of these hours are spent studying or discussing CFP Board's Code of Ethics or Practice Standards.

In addition to the biennial continuing education requirement, all CFP practitioners voluntarily disclose any public, civil, criminal or disciplinary actions that may have been taken against them during the past two years as part of the re-certification process.

Questions to Ask When Choosing a Financial Planner

The questions below can help you to effectively interview and evaluate financial planners to find the one that's right for you. You want to select a competent, qualified professional with whom you feel comfortable - one whose business style suits your particular financial planning needs.

Experience

Find out how long the financial planner has been practicing and the number and types of companies with which he/she has been associated. Ask the planner to describe past work experience and how it relates to his/her current financial planning practice. Choose a financial planner who has at least three years' experience providing financial planning services.

Qualifications

Ask the planner what qualifies him/her to offer financial planning advice and whether he/she holds a financial planning designation, such as CFP. Look for a planner who has proven experience in financial planning topics such as insurance, tax planning, investments, estate planning, and retirement planning.

Services

The services offered by a financial planner depend on a number of factors including credentials, licenses, and areas of expertise. Financial planners must be licensed to sell insurance or unit trust products. Some planners offer financial planning advice on a range of topics but do not sell financial products. Others may specialize in a particular area such as retirement planning or risk management.

Approach

Ask the financial planner about the types of clients with whom he/she has worked and the financial situations with which he/she is familiar. Some planners prefer to develop one plan that takes into account all of your financial goals. Others provide advice on specific areas, as needed. Make sure the planner's viewpoint on investing is not too cautious or overly aggressive for you. Find out if the planner will implement the financial recommendations developed for you or refer you to other financial professionals or specialists.

A Matter of Trust

Finding the right professional to address your financial planning needs isn't always easy. Take your time when choosing a financial planner. Before making a decision, become familiar with the planner's business style and understand the level of services he or she provides. Look for a measure of the planner's commitment to ethical behavior and adherence to high professional standards. Most importantly, look for a financial planner who will put you and your needs at the center of every financial planning engagement.

NEW CONTINUING PROFESSIONAL DEVELOPMENT (CPD) GUIDELINES FOR REGISTERED FINANCIAL PLANNER (RFP) COURSE

The RFP course is now recognized by both Bank Negara Malaysia for licensing of Financial Advisers and Securities Commission for licensing of Investment Advisers (which carries the title "financial planners").

In recognising the importance of the RFP designation to upgrade professionalism of life insurance agents as well as to promote the development of the financial planning industry, LIAM will now accord greater significance of the RFP course for the CPD hours. In addition, this is also to encourage life insurance agents to pursue the full RFP qualification.

As such, with effect from 1 January 2005, the CPD hours for the RFP course would be revised as follows:

Compulsory CPD Training Course

1. With effect from 1 January 2005, Module 1 (M1) and Module 2 (M2) of the RFP programme shall be made compulsory as one of the training courses for compliance of the CPD training hours.

2. An agent/agency manager shall be required to fulfill M1 and M2 only once in his entire career in life insurance selling. For instance, if the agent/ agency manager has fulfilled M1 and M2 for CPD in the previous life insurance company and he subsequently joins a new life insurance company, he will not be required to attend M1 and M2 again for CPD compliance. However, he/she should fulfill the CPD hours through other courses.

Earning of CPD hours for online RFP Modules

1. View the online training, then take the test to qualify for CPD hours.

2. You can try the test as many times until you are satisfied during your active subscription period. We will only submit your results for CPD entitlement at the end of every month. All submission of results will be based on the latest grade you achieve.

3. You are required to achieve at least 60% (Total Content Accessed) and 40% and above (Total Highest Score) to pass for your CPD hours

Note : A total of 15 CPD points will be awarded in the completion of each course (Module 1 or Module 2)

|

The CFP Board of Standards, Denver, is a non-profit professional regulatory organization founded in 1985 to benefit the public by fostering professional standards in personal financial planning. Individuals who meet rigorous certification requirements are licensed by the CFP Board to use its federally registered trademarks CFP® and Certified Financial Planner®. Your Career As a CFP Practitioner Personal financial planners help individuals determine whether and how they can meet their life goals through proper management of their financial resources. In addition to the opportunity for a rewarding career, you will have the satisfaction of helping people from all walks of life resolve their financial issues and reach their financial goals. |

The CFP designation identifies individuals who have both the academic and professional training. CFP licensees are qualified to provide advice with regard to all aspects of financial planning and to write comprehensive financial plans that meet international standards. Financial planners who are CFP licensees are highly sought after for their advice, as the credential assures the public that CFP licensees have agreed to adhere to high standards of competence and ethical practice. The strength of the CFP designation lies in the fact that it is a broad- based qualification, independent of any one industry and, therefore, are acknowledged to be objective professionals. Individuals who wish to attain the CFP designation must meet all the 4Es of the certification requirements, namely.

| Education | Successful completion of an approved education program |

| Examination | Successful completion of all FPAM required examinations |

| Experience | A minimum of 3 years work experience in financial planning or related fields |

| Ethics | Adherence to a professional Code of Ethics and Practice Standards as stipulated for all FPAM members |

With effect from 1 July 2002, members can select any of the 3 options to complete the CFP™ certification course.

Option A - CFP™ certification course

Members with SPM qualification or equivalent are required to sit for the whole CFP certification course, which comprise Module 1 to 6.

Option B - Partial exemption on Modules

The Board recognizes that certain professional qualifications cover some of the components in financial planning and have decided to waive certain Modules for eligible members.

Option C - CFP challenge status

The Board has approved certain qualifications and/or professional credentials as fulfilling the education requirements and members who are eligible can apply to FPAM for approval under the CFP challenge status. Under this CFP challenge status, the approved member is only required to sit for Module 6.

Members without any relevant qualifications are required to sit for the whole CFP certification course, which comprise Module 1 to 6.

The Board recognizes that certain professional qualifications cover some of the components in financial planning and have decided to waive certain Modules for eligible members. Holders of these degrees and /or credentials are exempted from the following modules:

| Qualifications |

Modules |

|||||

|

M1 |

M2 |

M3 |

M4 |

M5 |

M6 |

|

| Chartered Financial Practitioners (Namlifa) |

X |

|||||

| MII Dip. In Financial Planning |

X |

|||||

| Chartered Life Underwriters |

X |

X |

||||

| Life Underwriters Training Council of Fellows |

X |

X |

||||

| Graduate Diploma in Applied Finance and Investment |

X |

X |

||||

| Member of Malaysian Institute of Taxation |

X |

|||||

| Bachelors Degree (Finance / Accounting/ Economics) |

X |

|||||

Members having the following qualifications and/or professional credentials and have gained 3 years of personal finance related experience are eligible to apply for the CFP challenge status. This CFP challenge status is only open to Malaysians.

(1) Qualifications

Professional accountants (MIA, CPA(M), CPA(Aust), AICPA, CA , ACCA, ICMA & AIA.)

Chartered Secretaries (ACIS / FCIS)

Company Secretaries (Fellow of MACS)

Chartered Financial Consultants (ChFC)

Chartered Financial Analysts (CFA)

Doctorate in Business Admin (DBA)

PhD (Business, Accounting or Economics)

Masters (Business Admin /Finance /Economics/Accounting) from accredited universities

(2) Members must have gained 3 years of personal finance related experiences at the time of application where such experiences gained can enhance the candidate's ability to apply the financial planning process to meet consumer needs. This experience can be gained in one or all of the following areas: Insurance, mutual funds, securities, asset management, accounting, estate planning, banking, taxation, trusts, retirement planning and financial planning.

(3) Each member is entitled to a maximum of 3 consecutive examination attempts only for the challenge status commencing immediately after obtaining approval from FPAM. After the 3 attempts or non-attempts, they must enroll for the normal CFP certification examinations.

|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

Malaysia Life insurance company offers an innovative range of financial products to meet different customer needs. Malaysia insurers have innovative range of financial protection and wealth management products and services are available through the Malaysia Life Insurance Agency force, selected financial services organizations as well as financial advisor practices.

The product portfolio covers a broad range of needs, which include:

- Life Protection

- Retirement Planning

- Education Planning

- Savings & Investment

- Health & Medical

- Income Protection

Life insurance is a contract between an individual and a life insurance company. The individual agrees to pay a premium and in return, the insurance company promises to pay a predetermined amount of money to:

- The insured, in the event he or she becomes disabled or when some specified event takes place, and/or;

- A beneficiary or beneficiaries if the insured dies.

In order for the insurer to have enough money available to pay death benefits when they become due, insurance companies use a pricing system known as the legal reserve system. This system is based upon several premises:

- The amount of the death benefit promised in the insurance policy should be calculable in advance of the insured's death;

- The money needed to pay the benefits should be collected in advance, so that funds will be available to pay claims and expenses as they occur;

- The premium an individual pays for an insurance policy should be directly related to the amount of risk the insurer assumes for that person.

2. Can you provide a short history of life insurance in Malaysia?

Records indicated that the first life insurance policy was written in 16th century England.

The insurance industry in Malaysia first started in the 18th century. The insurance industry then was based on the British system because it was introduced and managed by British trading companies and agencies. There were few locals involved due to lack of expertise.

The insurance industry really took off only in the 1950s. The market then was controlled by British and American firms. At the same time, locally incorporated companies had also started selling insurance. After independence in 1957, nationalistic policies gave much encouragement to domestic companies to improve their market share. However, this boom burst when many companies, without proper underwriting practices, went out of business leaving their policyowners holding worthless policies.

The government stepped in to remedy the situation by introducing the Insurance Act, 1963. The office of the Director General of Insurance was given the task of regulating the insurance industry. Today, the Governor of Bank Negara is also the Director General of Insurance.

There are at present 9 Takaful and 16 life insurers operating in Malaysia.

Of the 16 domestic life insurers, 3 are listed on the Bursa Malaysia, one of which is Manulife Insurance Berhad, which is sponsoring this FAQ.

3. Why do people buy life insurance?

The reasons are:

- It provides a guaranteed source of income in the event of a wage earner's sudden death, to pay for funeral and final expenses, unpaid bills, taxes and other financial obligations e.g. our Convertible Term Plan.

- It safeguards a family's present standard of living, preventing its sudden drop after the death of the breadwinner e.g. our Competitive Whole Life Plan.

- It provides a convenient, disciplined way for a family to set money aside on a regular basis to ensure they will have the financial means necessary to pay for their children's university education e.g. our EduLink.

- It offers a safe, reliable savings plan for future goals and opportunities.

- It furnishes an important income supplement when earning power is destroyed by an illness or accident, as well as the means to pay for unexpected medical expenses e.g. our Comprehensive Medilife Riders and Lady's Comprehensive Medilife Riders.

- It protects home mortgage payments against an untimely death e.g.our Convertible Term Plan.

- It makes up an important part of a fringe benefits package provided to staff members by an employer e.g. our key employees and protection solution.

- Life insurance has often been described as "a friend in time of need". Essentially, it is a safety net for those times when financial hardship is created by an unforseen emergency or when regular income is lost.

4. What are the basic types of life insurance?

There are four basic types of life insurance policies. They are

- Term Insurance

- Whole Life Insurance

- Endowment Insurance

- Investment-Linked Insurance

All policies sold by life insurers in Malaysia are a variation and/or combination of these 4 basic types.

A fifth type of life insurance is Family Takaful. At present, only nine companies, empowered by the Takaful Act 1984, Syarikat Takaful Malaysia Bhd, Etiqa Takaful Bhd, Takaful Ikhlas Sdn Bhd, Takaful Nasional Sdn Bhd, MAA Takaful Bhd, Prudential BSN Takaful Bhd, HSBC Amanah Takaful (Malaysia) Sdn Bhd, Hong Leong Takaful Bhd, Tokco Marine and Commerce Aviva Takaful Bhd are selling this type of life insurance.

Annuities are the opposite of life insurance because the annuitant will receive the policy benefits provided he is living.

Superannuation is also offered by some insurers.

5. Where or from whom can I buy life insurance?

And if you had to know about the alternative channels, they are:

- Ordinary life insurance agents.

- Home Service or industrial life insurance agents.

- Some of the credit card companies like AMEX and some of the banks sell life insurance by mass mailing to their charge, credit card and bank accountholders.

- Bancassurance, which is selling of insurance through a bank's established distribution channels.

- In theory, a Malaysian insurance broker will also procure life insurance for its clients but brokers are relatively inactive with respect to life insurance in Malaysia.

- Some companies buy group insurance directly from life insurers or indirectly through insurance brokers and offer it as a form of benefits to their employees.

- In theory, you can walk into a life insurance company and ask to buy a life insurance policy. But why not go through an agent? His valuable service will not cost you anything.

Home Service life insurance agents differ from ordinary life insurance agents in the area of premium collection. A Home Service agent will visit his customers every month to collect premium.

Except for the first premium, customers of ordinary life insurance agents, are expected to pay direct to the insurers. However, some ordinary life insurance agents also offer the collection service.

All of the life insurers and many life insurance agents and brokers are listed in the Yellow Pages.

6. Is it legal to buy life insurance from a foreign life insurer?

It is perfectly legal to buy life insurance from one of the four foreign constituted life insurers that are registered under the Insurance Act to transact life insurance business in Malaysia.

However if the foreign insurers are not registered under the Insurance Act of 1963, then they are prohibited from selling life insurance in Malaysia. Furthermore, the same Act states that no person shall carry on insurance business in Malaysia as an insurance agent for an insurer not entitled under this Act. The same prohibition applies to brokers.

Thus, it stands to argue that if you buy insurance from an agent of a foreign insurer, you may be accused of aiding him or her in breaking the law. Bank Negara has been investigating such agents to protect Malaysians from the risks involved in dealing with non-registered companies.

7. What is the Consumer Education Program?

The Consumer Education Programme (CEP) on insurance and takaful is known as InsuranceInfo and is a joint effort between Bank Negara Malaysia and the insurance and takaful industry. The InsuranceInfo is designed as a long-term programme to provide educational information to enable consumers to make well-informed decisions when purchasing insurance or takaful products.

Click here for InsuranceInfo.

8. What bodies are playing a significant role in the life insurance industry in Malaysia?

They are :

|

a. |

Director General of Insurance This office is set up under the Insurance Act of 1963 to regulate and supervise the life insurance industry in Malaysia . At present, the director general of insurance is also the governor of Bank Negara. Thus, we often use the term Bank Negara and director general of insurance interchangeably. |

Bank Negara Malaysia |

03-2098 8044 |

| b. |

Life Insurance Association of Malaysia (LIAM) |

4, Lorong Medan Tuanku Satu, Medan Tuanku, |

03-2691 6168 |

| c. |

National Association of Malaysian Life Insurance & Financial Advisors (NAMLIFA) |

Wisma NAMLIFA, |

03-9281 3167 |

| d. |

National Insurance Association of Malaysia (NIAM) |

NIAM Secretariat |

03-2692 40 |

| e. |

Actuarial Society of Malaysia (ASM) |

c/o Actuarial Dept, Great Eastern Life Assurance (Malaysia) Berhad Level 20, Menara Great Eastern 303, Jalan Ampang 50450 Kuala Lumpur |

03-4259 8024 |

| f. | Malaysian Insurance Institute (MII) This is a non-profit organisation that conducts courses for the staff and agents of the insurance industry. |

5 Jalan Sri Semantan Satu, |

03-2094 4234 |

| g. |

Kesatuan Agen-Agen Melayu (JAMIN) |

Suite 9C , 9 th Floor, |

03-2146 9083 |

9. If I have just signed a proposal form, when does my coverage begin?

The answer to this question is complicated.

If you have only submitted a life insurance proposal or application form, then you are not covered at all.

If you have submitted payment together with your proposal form, then the life insurer is liable to the extent specified in the receipt. Usually the receipt will specify the insurer's liability as a maximum sum or your proposed sum insured, whichever is smaller, for a certain maximum period.

Most of the insurers intend their full liability (which is your proposed sum insured unless they counter propose) to start from the latest of the following four dates:

- Date of receipt of application or proposal form by the insurer.

- Date of receipt of full payment for 1st premium.

- Date of receipt of last compulsory underwriting document.

- Policy date stated in insurance policy.

Common sense may suggest that date of coverage will start with the policy date stated in the policy. However, in practice, some policyowners prefer to back date their policy so that the premium is calculated based on the lower age. This results in a lower premium at the expense of being not covered for the backdated period.

10. What can I do to minimize my life insurance policy premium?

There are several options. They are:

- Buy the policy as early as possible. The premium amount is usually dependent on the age of the insured, rising together with the age of the insured.

- Depending on your age and chosen policy plan, there is an upper limit on your proposed sum insured beyond which you are required to undergo a medical examination. It is possible that the medical examination may uncover factors which will make you ineligible for preferred risk discounts or even worse incur a higher than normal premium amount. Subject to the condition that you are not currently aware of any such medical condition, you should first purchase all the life insurance that you may require just up to the sum insured limit for no medical examination. After that, if you still require further insurance, by all means, go for the medical examination and purchase the additional coverage. The findings of such subsequent medical examination will have no bearing on the premium of the first policy provided that you are not aware of these findings prior to applying for the first policy.

Always answer the questions in the application form truthfully and completely to the best of your knowledge, even if the truth may cause the premium to be higher. Insurance contracts are based on the doctrine of utmost good faith. In the event of a claim, if the claims manager discovers that you have withheld information material to the claim, your policy can be invalidated and your beneficiaries may receive nothing. A policy that returns nothing is infinitely more expensive than a rated up policy.

- In general, term insurance which offers only protection is the cheapest. Whole life insurance which offers a mix of protection and savings is middling in cost, while endowment insurance offers maximum savings at a higher cost. Try to buy according to your needs and what your wallet can bear. Nothing is more expensive than a policy that you buy and abandon after a few years.

- If you are in good health, it is better to buy one large policy than several smaller policies. You will save by paying stamp duty only once and enjoying the size discount. Normally, insurance companies offer a discount on your premiums if your sum insured exceeds a certain amount. For instance, our Whole Life Special offer size discounts when your sum insured exceeds RM20,000. Thus your cost per RM1,000 of sum insured is reduced.

- Some companies offer policies that cover all members of your family. Such policies may be 30% to 100% cheaper than if you were to cover each member individually.

- If you are buying for the purpose of saving for a child's education, buy a plan insuring that child timed to mature at the time when the money is needed or that can gives you the flexibility to withdraw a lump sum of money when needed. Add a payor income rider insuring your life so that, in the event of your death, a regular income is payable to help keep the policy in force. Thus, your child is assured of a tidy sum when he or she needs it for education.

Malaysia insurer offers an education plan known as EduPlan. The premium on such education policies will be deductible against your taxable income up to a maximum of RM 3,000, subject to final approval by Inland Revenue Board.

- Many life insurers allow their policyowners to pay premium in advance by placing such advance premium in a special account that will earn interest until premium payment is due. Check with your insurer on the interest rate that they offer. You may be pleasantly surprised! However, please note that the rate is no more guaranteed than your savings account interest rate.

11. Is my life insurance policy premium tax deductible?

Section 49 of the Income Tax Act, 1967 allows some relief for premiums paid on life insurance policies or deferred annuities.

The premium is allowable when the life insurance or deferred annuity is on the

- Individual's life

- Spouse of the individual

- Her husband and any other wife or wives

Now, the relief from premiums on the life of the individual or his wife for one contract is restricted to the lower of the premiums paid or 7% of the capital sum insured. However, as of year of assessment 1997, this 7% restriction no longer applies.

The total relief allowable for all insurance premiums and contributions to approved funds (such as EPF) in the same basis year is RM 6,000. Married couples are entitled to separate relief of RM 5,000 each if the wife opts for separate assessment.

In addition to the above relief, an additional relief up to a maximum of RM 3,000 is given to a resident individual for premium paid for education or medical insurance. This is extended to premium paid for insurance on education or for medical benefits contracted for or by an individual for himself/herself, his/her spouse or child. In the case of separate assessment, the wife is also given a relief of up to a maximum of RM 3,000. Our EduPlan and ManuCare100 policy will qualify for this additional tax relief.

For taxable income for the year of assessment 2004 (Current year basis), the proposed tax relief for individuals has been increased to the following:

- Personal relief increased from RM5,000 to RM6,000

In the case of an employer purchasing life policies for his employees, the premium paid is usually treated as an allowable deduction (for the employer).

12. Are proceeds from my life insurance policy taxable?

Currently, the proceeds of a personal life insurance policy do not come under the definition of income under the Act, and hence, no income tax needs to be paid on the proceeds. The same applies to policy dividends and reversionary bonuses as these items are considered as refunds of premium, and additions to capital sum insured respectively.

From the 1995 year of assessment onward, the proceeds of annuity contracts are also not treated as taxable income.

13. Why did my insurance agent advise me to create a S23 trust?

S23 refers to Section 23 of the Civil Law Act. This section of the Act states that a policy of assurance set up by any person on his/her life for the benefit of his/her spouse or children or both will be considered a trust in favour of the beneficiaries. Thus, the policy benefits shall not form part of the estate of the insured or be subjected to his/her debts. Please note that this type of trust is effective only if the beneficiaries are his/her spouse and/or children. Thus, the beneficiaries are guaranteed to receive the benefits, free of any claims from creditors of the policyowner.

14. What are the common reasons for a life insurer to refuse a claim?

For death claims, the common reasons are:

- The policyowner's or insured's failure to disclose material facts with intention to defraud the insurer. The keyword here is material. If the insured died of a heart attack and he/she was known to suffer from heart problems prior to applying for the policy and yet did not disclose this information in the proposal form, then the insurer is likely to deny the claim. On the other hand, if the insured died of an accident entirely unrelated to his heart problems, then the insurer is likely to pay even if the heart problems were not disclosed in the proposal form provided that the heart condition was not so severe that the insurer would have rejected the application had the insurer knew.

- Policy lapsing before the insured died. Malaysian life insurers usually offer a grace period of 30 days for premium payment. If insured died on the 31st day after the premium is due, then his/her policy will have lapsed and no claim will be payable.

- It has been ruled that it is the duty of the policyowner to pay his premium on time.

- The insured died as a result of suicide within a fixed period of time from date of commencement of the policy. In such an event, the insurer is not liable to pay the claim except to refund the premiums paid. In Malaysia, this fixed period ranges from 1 to 2 years depending on the insurer and the product.

For hospitalisation and surgical claims, the usual reasons for claims rejection are:

- Claiming on a non-covered event e.g. cosmetic surgery.

- There is usually a waiting period of 30 days before any claim is accepted. Without the waiting period, the number of claims would be much higher, resulting in a higher cost of claims. This would, in turn, lead to higher premiums, making such policies much less affordable.

- Excluded risks e.g. hospitalisation due to alcoholism or substance abuse.

- Claims arising from a pre-existing condition e.g. claims on an operation to treat a condition that the insured was already suffering from before taking up the policy.

For totally and permanently disability claims, a common reason for claims rejection is that the insured's conditions do not satisfy the definition of total and permanent disability.

Accidental death claims may also be rejected for deaths arising from suicide, alcoholism and substance abuse. Outside the suicide period, the basic plan will always pay, even for suicide. Of course the suicide clause does not apply to accident riders.

15. Should I replace my present life insurance policy with that seemingly cheaper and better policy?

This is about comparing two policies. Life insurers have packaged their products with myriad features and it is difficult to get two identical policies from different insurers. Furthermore, there are the intangibles like reliable service from the agent and the insurer, financial stability of insurer, etc.

In general, a policy that has been in force long enough to acquire cash value should not be surrendered for another policy. The drawbacks of surrendering a policy after it has been inforce for some time include:

- Immediate loss of protection for the insured

- Higher cost of purchasing a new policy as the insured is now older

- The three year period for the cash value build up will have to start again

- The suicide and incontestibility clauses will begin anew

It is therefore recommended that you confer with your agent before surrendering your policy. If your agent is no longer working for the same company, then you should check with the original company. They may assist you in working out an amicable solution.

16. What should I look for when I am shopping for a life insurance policy?

First, you must identify your needs and the amount of premium that you can afford. Your possible needs are protection and savings. Protection refers to your need to provide financially for your loved ones in the event of your untimely death. Savings refers to your need to accumulate funds for future use.

Just as you insured your car, your house or your business for their value, so should you insure your life for its value to your dependents. If you are married and have children, an amount of 5 to 10 times your annual income should be sufficient unless you have extra debts or obligations or business interests. A professional agent can properly assess your actual need for protection and savings and recommend the proper policy to meet your needs.

17. How late can I pay my premium?

You must pay your premium before the due date plus grace period stated in your policy. Most Malaysian insurers prescribe a grace period of 30 days or 1 month for most policies. However, please read your policy to determine the exact grace period.

If you die before the grace period expires, then you are still covered even if you have not paid your premium. If you die exactly on the date of grace period expiry, and premium has not been received before that date, then you are not covered.

If you are paying premium directly to an office of the insurer, you will normally be given an official receipt immediately. The receipt is normally adequate proof that you have paid your premium. This is provided that your payment is by cash or by cheque and the cheque is honoured by the bank.

Legally, if you are paying premiums through your ordinary life agent, then it depends on whether the agent has authority to collect premium. If he has, he usually can provide you with a temporary receipt immediately upon receiving the premium. Usually such authority is given to the agency supervisor and more senior agents. However, not withstanding this legal position, most insurers will recognise even payment to agents that are not given official authority to collect premium, provided that the agent admits receiving the premium or the policyowner can prove that he paid the premium to the agent.

Home Service agents are always given authority to collect premiums. Indeed, after collecting the premium, the Home Service agent will always acknowledge receiving the premium by signing the relevant pages of the premium receipt book held by the policyowner.

The above discussion on non-coverage is further subject to the provision that if, on the premium due date, the policy has been in force long enough to accumulate surrender value, then the policy remains automatically in force for a period equal to what the surrender value will buy. Furthermore, if the policy has accumulated any dividends or if the insurer is holding some money on behalf of the policyowner in respect of his/her policy, the insurer will usually use this money to keep the policy in force for as long as the money will cover.

For further details, please refer to the discussion on non-forfeiture options.

18. What are my options if I cannot continue paying my premium?

In life insurance jargon, these are known as non-forfeiture options or discontinuation benefits.

If you are unable to pay even one more sen, and if your policy has accumulated some surrender value, then your options are:

- Surrender your policy and you will receive the surrender value. Within your policy contract, there will be a table stating the surrender value for each policy year i.e. the complete number of years for which premium has been paid. If you have paid for a few more months, the insurer will usually interpolate between the two surrender values. The exact interpolation formula varies by insurer.

- To take a loan against the surrender value that your policy has accumulated instead of surrendering your policy for its surrender value. This way, you get your money and the policy is still in force provided that you have paid your premium.

- Surrender one or more of the riders or surrender some or all of the existing bonuses for their surrender value. This way, you are still covered under the basic plan.

- Convert to a reduced paid-up policy according to the amount of surrender value available. This means that your sum insured is reduced but you are still covered for the original period. You are not required to pay any further premium.

- Convert to an extended term insurance according to the amount of surrender value available. This means that your policy has now become a term policy with a sum insured equal to the original sum insured less any policy loans. The period of coverage depends on the amount of surrender value available. All of the original riders will be terminated. You are not required to pay any further premium.

- Exercise an Automatic Premium Loan. This means that on each premium due date, the life insurer will automatically make a policy loan equal to the premium due, and use it as your premium payment. This is often the basis of "vanishing premium" and "limited payment" policies. For such policies, their surrender value accumulates so fast that the insurer can use them to pay premium until the policy matures.

If you do nothing, the insurer will follow the non-forfeiture option that you chose in your application form. If you did not select any non-forfeiture option in your application, then the insurer will take the default non-forfeiture option stated in your policy contract. In Malaysia, this is often automatic premium loan. Our Insurance Act and the Director General of Insurance have not mandated any standard default non-forfeiture option. Also, please note that even for a given insurer, he may specify different default non-forfeiture options for different products and/or for contracts issued at different times.

19. What are "limited payment" or "vanishing premium" policies?

These are policies in which the premium paying term is less than the actual term of the policy. There are two such types of limited payment schemes. One is guaranteed and the other one is not guaranteed.

In "guaranteed" schemes, the insurer guarantees that you will have to pay premiums for no more than the stated period or until a stated date.

"Non-guaranteed" schemes are always for policies with profits or which are participating. In such schemes, the life insurer is saying that, based on the expected investment return, interest rate, etc., you can probably stop paying premium by the end of that calculated period or date. Under Bank Negara guidelines on sales illustrations, there is always a statement alerting the prospect to the non-guaranteed nature of this payment scheme. However, selling of insurance using this practice has been discontinued by Bank Negara Malaysia since April 2001.

Generally, all else being equal, the guaranteed policies are usually more expensive than the non-guaranteed ones. Normally, an insurer will do the utmost to achieve the projections given in the sales illustration as failure to do so may be disastrous to the company's new business growth, even though the insurer is not under any legal obligation to meet these projections. Of course, the guaranteed portion, if any, of the policies represents a legal commitment the insurer must meet.

Life Insurance Terminology

1. What does life insurance with or without profits mean?

Many life insurance companies offer whole life policy or an endowment policy "with profits". Sometimes, the with profits policy is a rider that is attached to the whole life or endowment policy.

A "with profits" policy is one where the policyowner shares in the profits that the company makes, and these are added to the benefit which is finally paid out. All else being equal, the premium payable will be more than that of a without profits policy. As you would have gathered by now, a without profits policy is one which does not share in the profits that the company makes.

2. What does participating or non-participating life insurance mean?

A participating life insurance policy (also called a with profits policy) is one which will participate in the distribution of surplus if the life insurance company's experience is favourable. Conversely, a non-participating policy cannot do so. Policyowner of a participating policy will pay a higher premium for a given sum insured than a non-participating policy because he/she will usually receive greater benefits.

Usually, the policyowner can elect to convert a non-participating policy into a participating one by payment of additional premium. The additional premium will commence from the anniversary date immediately following the date of conversion. The bonuses are granted only for the future period commencing from the date of such conversion.

However, policyowners are usually not allowed to convert a participating policy into a non-participating one. The rationale behind this is that all policyowners may want to convert their participating policies into non-participating ones when the company is undergoing a bad experience.

Sometimes, the participating policy is the rider attached to the basic policy plan (which is non-participating by itself). In this case, the rider can be attached at any time during the term of the basic policy plan subject to insurability.

3. With respect to life insurance, what is a bonus?

A bonus is a refund of excess premium paid to the policyholder of a participating policy. Such bonuses are paid out of the insurer's divisible surplus if the insurer's actual experience is favourable. These bonuses are usually deferred in that they are only payable at the end of the term of the policy, or when a claim arises. They cannot be withdrawn during the term of the policy; however, they do have a cash value (after a period of 3 full years, usually) and should the policy be surrendered, the cash value can be obtained.

4. What is a simple reversionary bonus?

A simple reversionary bonus is one that is calculated on a simple interest basis. At the end of each policy year, an annual bonus will be declared and this amount will earn interest for the remainder of the term of the policy. In this case, the interest on the bonuses that have been accumulated does not earn interest; only the principal amount earns interest.

5. What is a compound reversionary bonus?

A compound reversionary bonus is one that is determined on a compound interest basis. In this case, interest will be earned on the total of bonuses declared and accrued interest, i.e. both the bonuses declared and accrued interest will earn interest.

Bonuses on a compound interest basis accumulate at a faster rate than those on a simple interest basis.

6. What is a death or claims bonus?

A death bonus is one which is only payable on death. It is usually incorporated into a reversionary bonus rider to enhance the benefit payable on death. It is payable in addition to the sum of the annual bonuses which have been declared and vested at the time of death. However, if the insured survives until the maturity of the rider, the death bonus will not be payable. Some insurers will include the death bonus in the benefit payable for total and permanent disability claims.

The death bonus is usually only payable after the policy has been in force for a certain number of years. This is to allow the death bonus to accumulate to a significant amount. The rate is also dependent upon the company's financial condition at the time of claim.

7. What is a final, terminal or maturity bonus?

A final, terminal or maturity bonus is one which is payable at policy maturity. This bonus is payable in addition to the sum of the annual bonuses which are declared at the end of every year during the term of the policy. However, the final bonus is not payable on death or total and permanent disability.

The rate of final bonus will depend on the company's actual experience at the time of policy maturity.

8. What are guaranteed cash payments?

Guaranteed cash payments are cash payments which are paid at regular intervals during the term of the policy. This feature is usually found in permanent insurance plans such as whole life and endowment. The payments are guaranteed and are made as long as the insured is still alive.

As our country's health care system improves, the average person will live longer. Thus, such policies will become more expensive as the insureds live longer and thus collect more payments.

A good example of a policy with guaranteed cash payments is our Whole Life Special.

9. What are policy dividends?

Policy dividends are a refund of excess premium paid to the policyholder of a participating policy. Such dividends are paid out of the insurer's divisible surplus. In this case, the policyholder is given the right to participate in the distribution of surplus if the company's actual experience is sufficiently favorable. This distribution of surplus comes in the form of a policy dividend. The policy dividends can be kept with the insurer or withdrawn. If they are kept with the insurer, interest will be earned on the accumulated sum. The rate of interest is determined by the insurer.

10. What is policy cash value or surrender value?

Policy cash value or surrender value is the amount of money the policyholder will receive as a refund if the policyholder cancels the coverage and returns the policy to the company.

The cash value is only available for permanent insurances such as whole life and endowment. In these cases, the cash value is only available after the policy has been in force for three full years. This payment of cash value after a minimum period of three full years is guaranteed by law.

11. What is a policy loan?

A policy loan is one which is taken out on the security of the policy. It can only be taken out if the policy has a cash value. There is usually a cash value after the policy has been in force for three full years. Theoretically, the maximum loan value of a policy is 100% of the cash value. However, in practice, in order to prevent the sum of the loan value plus accrued interest from exceeding the cash value (causing the policy to lapse), the maximum loan value that will be taken out is 90% of the cash value.

The rate of interest charged on the loan will be determined by the company. An notice showing the outstanding balance and interest due will be issued to the policyowner at least twice a year until the loan is fully settled. The interest which is not paid within one month after it has become due or by end of the company's financial year will be accumulated at compound interest. There will be a minimum period for which the loan must run. This minimum period varies between companies, but in general, it is six months. If repayment of the loan is made before the minimum period is over, interest for at least the minimum period may be charged.

The life insurer does not insist on repayment of the loan as long as the policy is in force. At any time while the policy is in force, the whole or any part of the loan (together with accrued interest) may be repaid.

At the time of a claim, ie. settlement in the event of death or maturity of the policy, any loan together with the accrued interest shall be deducted from the amount otherwise payable under the policy.

If the policy is converted into paid-up or extended term insurance, the outstanding loan amount is deducted from the available cash value before it is used to purchase the paid-up or extended term insurance.

Policy loans should not be confused with study loans that some insurers offer as an additional benefit to their juvenile or children's policies. Such study loans are real loans similar to what you can get from the banks or finance companies. It is given only when there are suitable loan guarantors and the insured can show evidence of acceptance by the university. Like bank loans, such study loans must be repaid.

If there is sufficient cash value, a policyowner can always apply for a policy loan to finance the insured's (or anybody's) university education without resorting to a study loan.

The current interest rate charged by Malaysia insurer on policy loan is at 8% per annum. A RM5.00 stamp duty is imposed per RM1,000 of the loan amount.

12. What is a policy date?

Providing that there was no backdating, the policy date is the date of inception of the policy. This means that the coverage provided under the policy will commence at the policy date stated in the policy. The premium rate is calculated based on the age of insured nearest to this policy date or next birthday after this policy date, depending on individual insurer's practice.

Backdating refers to the practice in which the policyowner selects his last birthdate as the policy date so that the lower premium rate applies. However, in such a case, the insured is not covered during the backdated period. Usually, the applicant is allowed to backdate his policy up to a maximum of six months.

13. What is a policy anniversary date?