Tokio Marine VitalCover Insurance

Covid19 Medical Income insurance Plan

Covid19 Medical Income insurance Plan

This is an income plan product that pays a lump sum benefit for hospitalization or death due to respiratory diseases including Covid-19.

@Guarantee Acceptance@

Whatsapp Hotline +6011-12239838

Buy Via Whatsapp Online and "Accept Touch n Go ewallet Payment".

http://wasap.my/+601112239838/CD19medicalinsurancequote

Tokio Marine Vital Cover - Covid 19 Medical Income Insurance Plan

This is an income plan product that pays a lump sum benefit for hospitalization or death due to respiratory diseases including Covid-19.

Tokio Marine VitalCover Insurance

Covid19 Medical Income insurance Plan

Tokio Marine VitalCover Insurance

Covid19 Medical Income insurance Plan

This is an income plan product that pays a lump sum benefit for hospitalization or death due to respiratory diseases including Covid-19.

@Guarantee Acceptance@

Whatsapp Hotline +6011-12239838

Buy Via Whatsapp Online and "Accept Touch n Go ewallet Payment".

http://wasap.my/+601112239838/CD19medicalinsurancequote

Tokio Marine Vital Cover - Covid 19 Medical Income Insurance Plan

This is an income plan product that pays a lump sum benefit for hospitalization or death due to respiratory diseases including Covid-19.

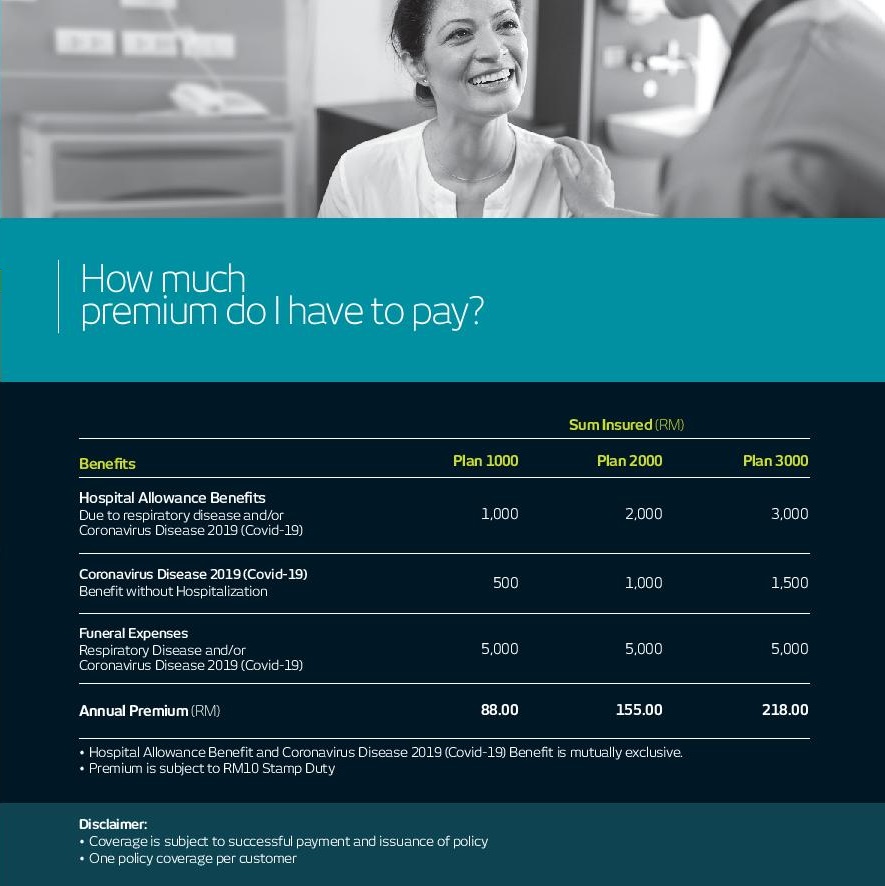

What are the covers / benefits provided?

This policy pays the following benefits in the event you are hospitalized due to Respiratory

Disease and/or Coronavirus Disease 2019 (Covid19):

Hospital Allowance Benefit due to respiratory disease and/or Coronavirus Disease 2019 (Covid-19)

Coronavirus Disease 2019 (Covid-19) Benefit without Hospitalisation

Funeral Expenses for death due to Respiratory Disease and/or Coronavirus Disease 2019 (Covid-19)

The Hospital Allowance Benefit and Coronavirus Disease (Covid-19) Benefit are mutually exclusive.

Note: Please refer to the policy contract for details of cover.

Duration of cover is for one year only.

You need to renew your cover annually.

What are some of the key terms and conditions that I should be aware of?

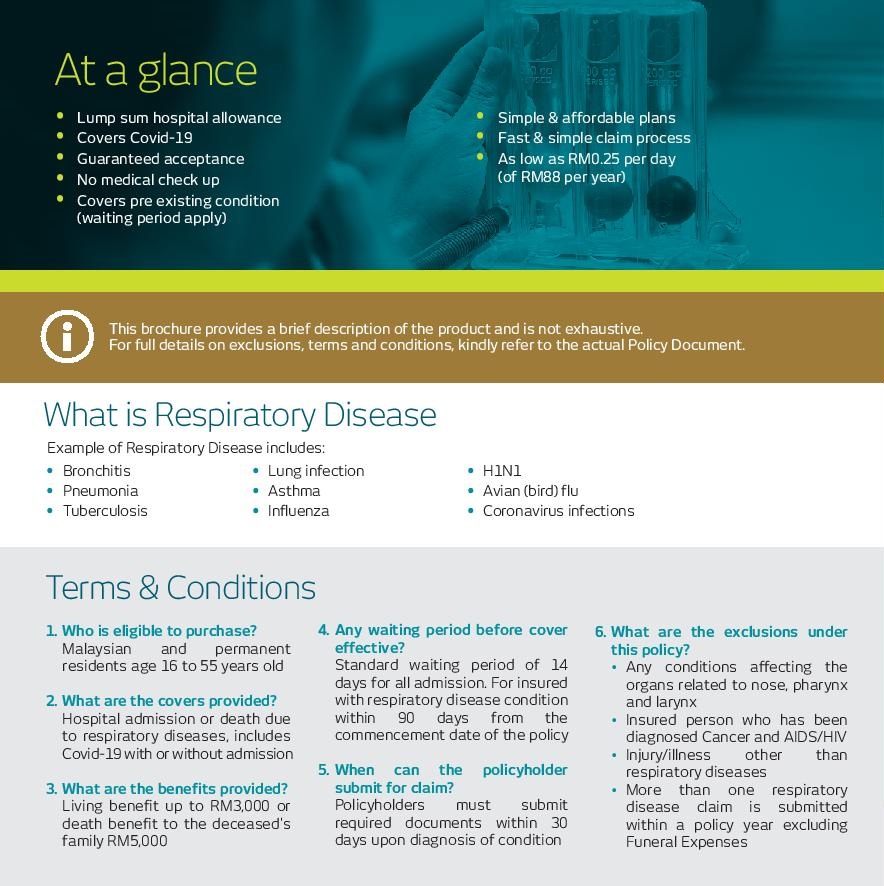

Age Limit: age next birthday of 16 years old to 55 years old

Importance of Disclosure:

According to Schedule 9 of the Financial Services Act 2013, failure to declare information truthfully and accurately may affect acceptance of the risk leading to this coverage being void and denial of claim.

If you notice any inaccurate information or to provide additional

information, please inform us immediately for our review and consideration.

Territorial Limit – the Event of Cover must be diagnosed in Malaysia by a Physician.

Multiple Policy – If there is more than one policy effected by you concurrently, we will pay you the benefits under a policy with the highest benefits.

We will terminate the other policies and a refund of the premium will be allowed.

Cash Before Cover

It is fundamental and absolute special condition of this contract of insurance that the premium due must be paid and received by us before cover commences.

If this condition is not complied with, then this insurance Policy is automatically null and void.

Cooling-off Period

You have the right to return this Policy within 15 days after we deliver it to you, if, for any reason, you are not satisfied with this Policy.

Qualifying / Waiting Period

Insurer will not pay the claim if insured has been diagnosed or hospitalized due to Respiratory Disease or Covid-19 within 14 days from the commencement date of the policy.

Period of Cover and Renewal

This Policy shall become effective as stated in the Policy; the policy is renewable at the premium rates in effect as that time as notified; and the policy is renewable at insurer’s option.

Application for change of benefits can only be made at renewal and subject to Acceptance

upon renewal.

Malaysia Medical Insurance Organisation (MMI)

158-3-7, Blok 158,Kompleks Maluri,

Jalan Jejaka, Taman Maluri,

55100 Kuala Lumpur, Malaysia.

MMI Careline + 603-92863323

+6011-12239838, +6012-6489838, +6017-3183811.

#Covid19

#TokioMarineVitalCover

#TokioMarineMedicalinsurance

#Covid19Medicalincomeplan

#MMI