Comprehensive Personal Accident Insurance, Travel Insurance, Senior Gold PA Insurance Policy arranged by Malaysia Medical Insurance Organisation (MMI)

| |||||||||||||||

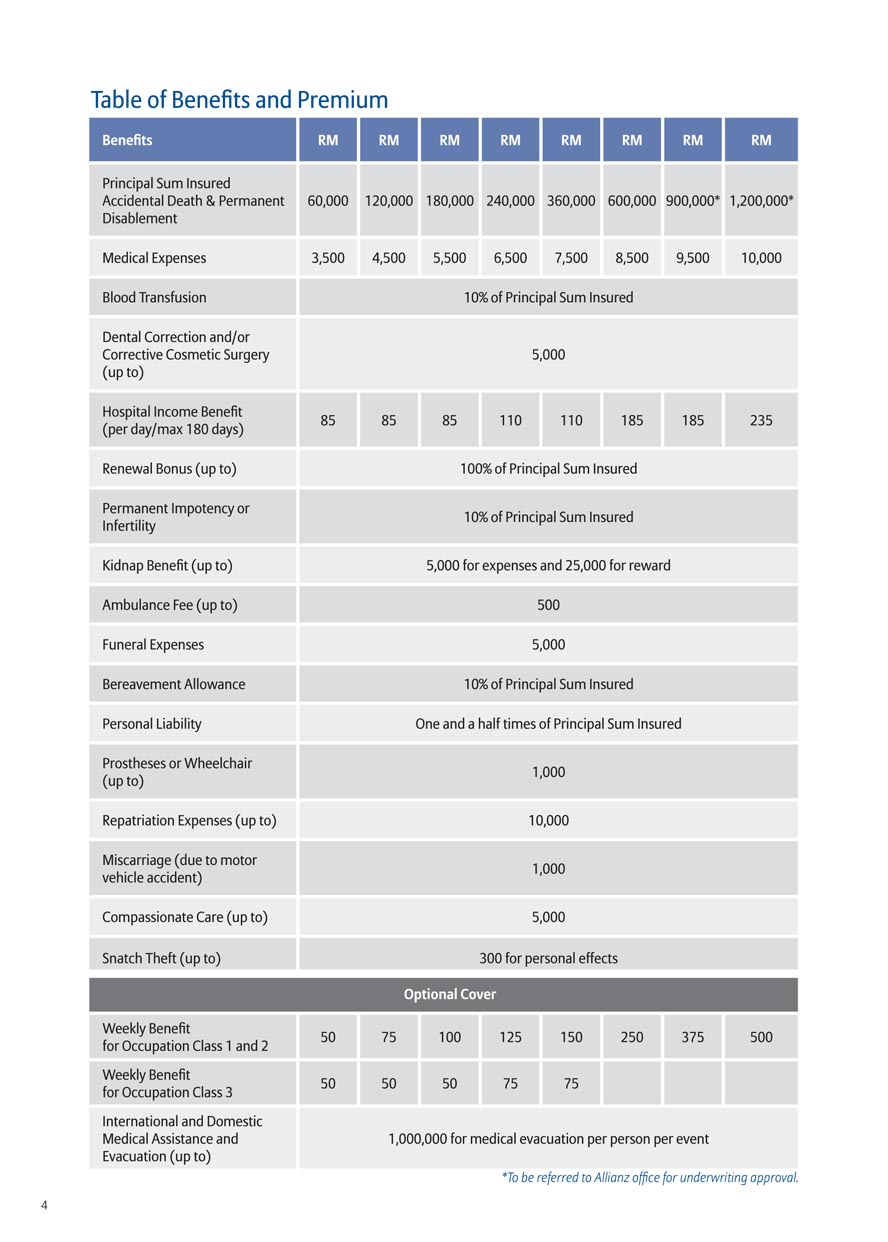

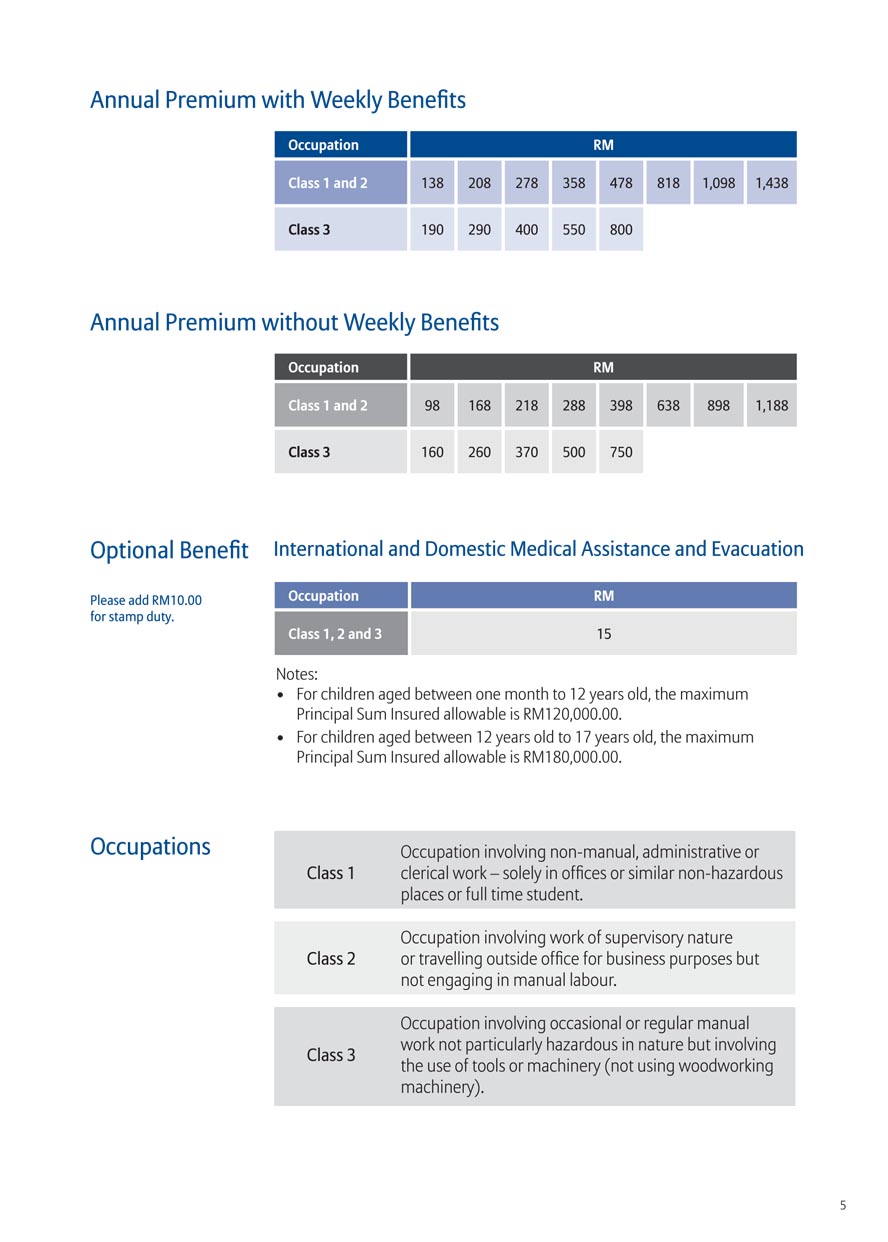

| Product description: Allianz Shield (Personal Accident Insurance Solution) Life happens! As it unfolds you’re hard pressed to keep up with the decision making. Should you buy a house? Should you invest? How about a car? Should you get married? What about kids? While you concentrate on the really important ones, we at Allianz are going to make some decisions easier for you. Which is why we’ve prepared a comprehensive range of personal insurance options to meet your needs so that you can spend more time on making your life happen the way you want it. No one can deny that life is unpredictable. But you can prepare for it by taking away the ‘what if’ and Allianz Shield yourself – the necessary addition to complete your life. With Allianz Shield, you will be covered for benefits such as

• Accidental Death and Permanent Disablement Extended Benefits:

• Motorcycling

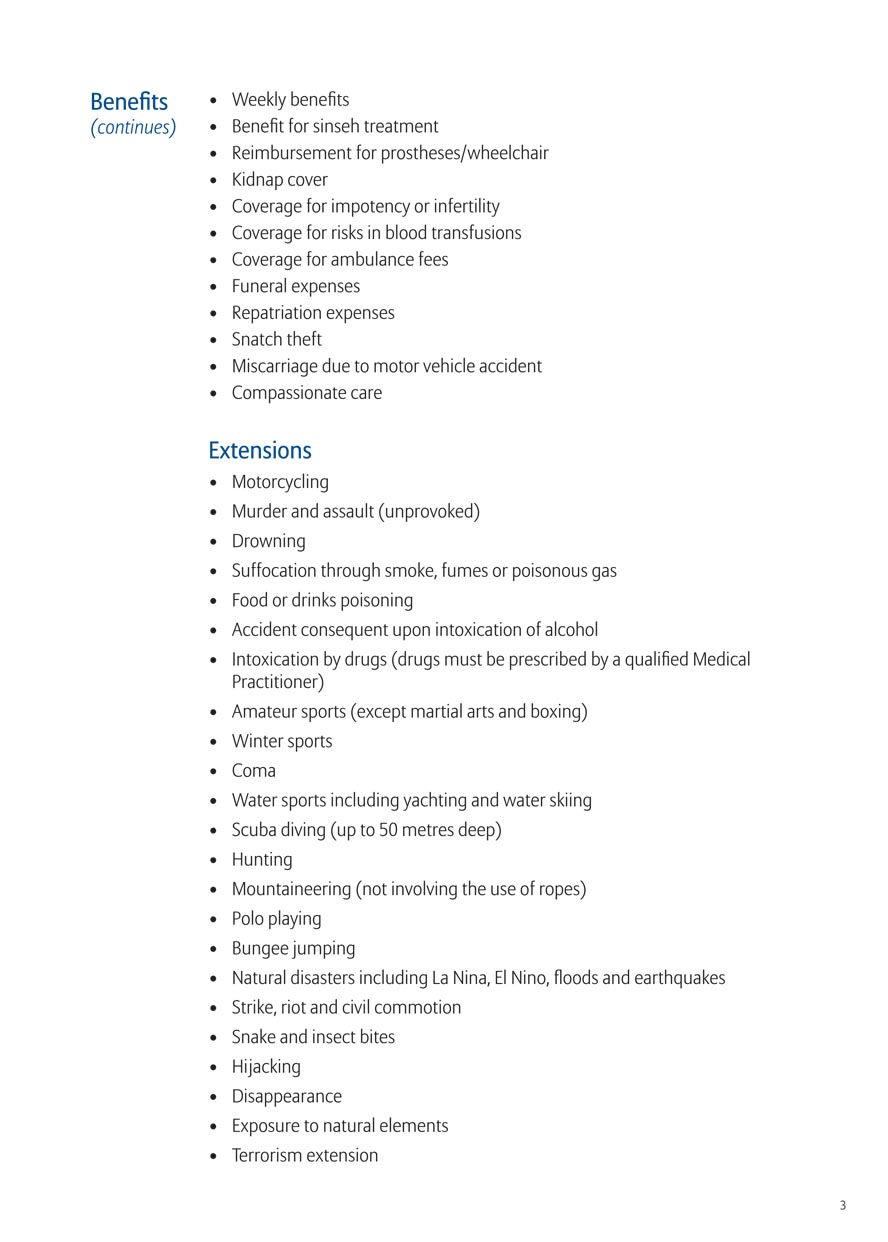

• Murder and assault (unprovoked) • Accidental Drowning or Near Drowning • Suffocation through Smoke, Fumes or Poisonous Gas • Poisonous Food and drink • Accident consequent upon intoxication of alcohol • Intoxication by drugs (drugs must be prescribed by a qualified Medical Practitioner) • Amateur sports (except martial arts and boxing) • Winter sports • Coma • Water sports including yachting and water skiing • Scuba diving (up to 50 metres deep) • Hunting • Mountaineering (not involving the use of ropes) • Polo playing • Bungee jumping • Natural disasters including La Nina, El Nino, floods and earthquakes • Strike, riot and civil commotion • Insect, snake and animal bites • Hijacking • Disappearance • Exposure to natural elements • Terrorism extension Allianz Shield is an annually renewable Personal Accident Policy. Summary information from Allianz Shield policy

Part 1 − Definitions

Accident means any sudden or unexpected and violent event, resultingdirectly and independently from the action of an external cause, otherthan any intentionally self-inflicted injury. Asia Pacific Countries is defined as Australia, Bangladesh, Brunei,Cambodia, China, Hong Kong, India, Indonesia, Japan, Laos, Macau,Myanmar, Nepal, New Zealand, North Korea, Pakistan, Papua New Guinea, Philippines, Singapore, South Korea, Sri Lanka, Taiwan,Thailand and Vietnam. Child/Children means the Insured Person’s biological/legally adopted/step child who has attained the age of thirty (30) days and is anunmarried person, is financially dependent upon the Insured Person

up to the age of eighteen (18) years or twenty four (24) years for thoseregistered as full time students at an Educational Institution. Company means Allianz General Insurance Company (Malaysia)Berhad (735426-V). Date of Loss/Accident means the day when any of the Injuries andother covered incident(s): (a) occurs; (b) is inflicted on; and/or (c) contracted by the Insured Person. Disability means a physical or mental condition that limits an InsuredPerson’s movements, senses or activities. Permanent Disablement means the conditions which are describedunder item B of Part 3 under the

Scale of Benefits.

Educational Institution means any school, vocational institute,polytechnic, college, university or institute of higher learning whichis operated by the government or licensed to provide educationalservices by trained or qualified teachers. Eligibility refers to the age of eligibility for the Insured Person to qualify for cover under this Policy which is from thirty (30) days up to the age of sixty five (65) years and renewal is up to eighty (80) years. Ages referred to in this Policy shall be in reference to the age as at the lastbirthday. Guardian means an individual who has legal guardianship over theInsured Person before he/she reaches the age of eighteen (18) years. Home means Insured Person’s usual place of residence in Malaysia.

Home Territory means Malaysia.

Hospital means any government or licensed hospital/medical centre which provides room, board and 24 hours a day nursing services and medical treatment (other than an institution for the aged, chronically ill, mental, convalescent or rest or nursing home). Hospitalization means admission to a Hospital as a registered inpatient for medically necessary treatments for a Disability upon recommendation of a Medical Practitioner. A patient shall not be considered as under Hospitalization if the patient does not physically stay in the Hospital for the whole period of confinement.

Family Member(s) means Insured Person’s legal spouse, parents, parents-in-law, grandparents, Children, grandchildren, brothers, sisters and legally adopted child or sibling, all residing in the Insured Person’s Home Territory. Illness means any sudden and unexpected deterioration of health certified by any Medical Practitioner during the Period of Insurance. Injury means bodily injury suffered anywhere in the world caused solely by an Accident and not by sickness, disease or gradual physical or mental wear and tear occurring during the Period of Insurance. Insured Person means person named or described in the Schedule and/or Policy and who must be a Malaysian, Malaysian permanent resident, work permit holder, pass holder or otherwise legally

employed in Malaysia and/or his/her spouse and Children who are legally residing in Malaysia. Medical Practitioner means a qualified Medical Practitioner licensed by the medical authorities of the country in which treatment is provided and who is practising within the scope of his/her licensing

and training. Period of Insurance means the duration for when an Insured Person is insured, subject to the terms, conditions and exclusions as set out in this Policy and the specific dates confirmed by the Policyholder to the Insured Person as set out in the Schedule. Personal Effects mean articles or items carried or worn by the Insured Person. Policyholder means a person or a corporate body as described in theSchedule to whom this Policy has been issued in respect of cover for the Insured Person(s).

Principal Sum Insured means the sum insured according to the type of plan purchased.

Public Transport Services means any licensed bus, taxi or a Scheduled Carrier which any member of the public can join at a recognised stop as a fare-paying passenger.

Schedule means the document which is issued to the Policyholder detailing the particulars of the Policyholder and the benefits provided under this Policy.

Renewal Bonus means a reward given for the absence of claims on this Policy in the preceding Period of Insurance. The Insured Person’s Principal Sum Insured is increased by 10% per annum for a maximum period of ten (10) years. To be eligible for the Renewal Bonus, renewal of the Policy must be continuous and the Policy has not been allowed to lapse in any given year. Payment of Renewal Bonus in addition to the Principal Sum Insured shall only be applicable under Benefits A (Death), B (Permanent Disablement) and C (Double Indemnity).

Scheduled Carrier means scheduled aircraft, train or sea vessel where the aircraft, train and sea vessel are listed with the relevant authorities in the countries in which the aircraft, train or sea vessel is registered and holds a certificate, license or similar authorisation for scheduled transportation and in accordance with such authorisation, maintainsand publishes schedules and tariffs for passenger service betweennamed airports, train stations and ports at regular and specific times. Part 2 − Exclusions

This Policy does not cover death or any injury/disablement directly or indirectly caused by or in connection with any of the following: 1. War, invasion, act of foreign enemy, hostilities (whether war be declared or not), civil war, rebellion, revolution, insurrection, military or usurped power; 2. Insanity, suicide (whether sane or insane), intentional selfinflicted injuries or any attempt thereat; 3. Any form of disease, infection or parasites and Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC) or Human Immunodeficiency Virus Infection (HIV). However the named diseases specifically mentioned under Benefits D and E may be covered under specific circumstances as detailed therein; 4. Childbirth, miscarriage, pregnancy or any complications thereof; 5. Provoked murder or assault; 6. While travelling in an aircraft as a member of the crew, except only as a fare-paying passenger in an aircraft licensed for passenger service; 7. While committing or attempting to commit any unlawful act; 8. While participating in any professional sports; 9. Martial arts or boxing, aerial activities including parachuting and hang-gliding, underwater activities exceeding fifty (50) metres in depth, mountaineering involving the use of ropes or mechanical guides; 10. Racing (other than on foot), pace-making, speed or reliability trials; 11. Ionisation, radiation or contamination by radioactivity, nuclear weapons material; 12. Riding/driving without a valid driving licence; 13. Liability assumed by the Insured Person by agreement unless such liability would have attached to the Insured Person notwithstanding such agreement; 14. Liability in respect of injury to any person who at the time of sustaining such injury is engaged in the service of the Insured Person or for compensation claimed from the Insured Person by an injured person or dependent under any Workmen’s Compensation legislation; 15. Liability in respect of injury to any person who is a member of the Insured Person’s own family or a member of the Insured Person’s household; 16. Liability in respect of damage to property belonging to or in the charge or under the control of the Insured Person or of any servant or agent of the Insured Person; 17. Liability in respect of injury or damage caused by or in connection with or arising from: (a) The ownership or possession or use by or on behalf of the Insured Person of any animal (other than a dog or cat), aircraft, motorcycle, vehicle, vessel or craft of any kind; (b) The ownership or possession or use by or on behalf of the Insured Person of any land or building; (c) Any employment, profession or business of the Insured Person or anything done in connection therewith or for the purpose thereof. 18. Liability for any consequence whether direct or indirect of war, invasion, act of foreign enemy, hostilities (whether war be declared or not), civil war, rebellion, revolution, insurrection, military or usurped power, mutiny, popular uprising, strike, riot or civil commotion. Part 3 − Scale of Benefits

Percentage of Principal Sum Insured A. Death (occurring within twelve calendar months of the Accident) 100%

B. Permanent Disablement

(occurring within twelvecalendar months of the Accident)

Loss of two limbs 100% Loss of both hands or of all fingers and both thumbs 100% Loss of sight of both eyes 100% Total paralysis 100% Injuries resulting in being permanently bedridden 100% Any other Injury causing Permanent Total Disablement 100% Loss of arm at shoulder 100% Loss of arm between shoulder and elbow 100% Loss of arm at elbow 100% Loss of arm between elbow and wrist 100% Loss of hand at wrist 100% Loss of leg at hip 100% between knee and hip 100% below knee 100% Eye : Loss of whole eye 100% all sight in one eye 100% sight of except perception of light 50% Loss of four fingers and thumb of one hand 50% Loss of four fingers 40% Loss of thumb both phalanges 30% one phalanx 15% Loss of index finger three phalanges 15% two phalanges 10% one phalanx 5% Loss of middle finger three phalanges 8% two phalanges 5% one phalanx 3% Loss of ring finger three phalanges 6% two phalanges 5% one phalanx 3% Loss of little finger three phalanges 5% two phalanges 4% one phalanx 3% Loss of metacarpals first or second (additional) 4% third, fourth or fifth (additional) 3% Loss of toes all 20% great, both phalanges 8% great, one phalanx 3% other than great, if more than onetoe lost, each2% Permanent loss of hearing in both ears and speech 100% Loss of hearing both ears 75% one ear 15% Loss of speech 50% Shortening of arm more than 1” up to 2” 2.5% more than 2” up to 4” 5% more than 4” 12.5% Shortening of leg more than 1” up to 2” 5% more than 2” up to 4” 10% more than 4” 25% Permanent Impotency or Infertility 10% Where the Injury is not specified, the Company reserves the rightto adopt a percentage of disablement which, in its opinion, is notinconsistent with the provisions of the above Scale.

Permanent Total Loss of Use of Member shall be treated as loss ofmember. Loss of Speech shall mean total permanent inability tocommunicate verbally.

The aggregate of all percentages payable in respect of any oneAccident shall not exceed 100%. In the event of a total of 100% havingbeen paid during the Period of Insurance, all Insurance hereunder shall immediately cease to be in force. All other losses lesser than 100%if having been paid shall reduce the coverage by that amount from thedate of Accident until the expiry of this Policy.

• Coma

Upon certification by a Medical Practitioner that the InsuredPerson has been in a coma state for at least one (1) year due toan Accident, the Company will pay 100% of the Principal SumInsured. However, the Company has the right to recover thepayment made if the Insured Person regains consciousness provided that a deduction be made of 10% of the aforesaidpayment for each year the Insured Person was in a coma state. • Disappearance If after a period of one (1) year has lapsed from the date ofreported disappearance and the Company having examinedall evidence available shall have no reason to suppose otherthan that an Accident has occurred which in all probability hasresulted in the death of the Insured Person, the disappearance of the Insured Person shall be considered to constitute a claimunder this Policy and the Principal Sum Insured shall be payable. However, if at any time after payment has been made the InsuredPerson is found to be living, any sums paid by the Company insettlement of the claim shall be refunded to the Company. • Exposure This Policy covers death or Permanent Disablement claimscaused by exposure to the elements as a result of an Accidentprovided that in the event of death of the Insured Person causedby exposure to the elements, the death is subject to an inquestby which it is found that the Insured Person died of exposure as aresult of an Accident. C. Double Indemnity

Benefits for A (Death) and B (Permanent Disablement) under thisPolicy will be doubled if the Insured Person suffers either death orpermanent total paralysis from the neck down or permanent total loss/loss of use of two (2) limbs due to an Accident: (i) whilst travelling as a fare-paying passenger on any mode ofPublic Transport Services or (ii) whilst travelling overseas* *Travelling overseas in this context would mean the following: • If Insured Person is a Malaysian – Insured Person is travellingout of Malaysia. If Insured Person also has a permanentresidence in another country, then this benefit is onlyapplicable if Insured Person is travelling out of Malaysiaand out of that country in which the Insured Person haspermanent residence. • If Insured Person is a Malaysian legally employed in a foreigncountry – Insured Person is travelling out of Malaysia and outof the country in which he/she is employed. • If Insured Person is a Non-Malaysian – Insured Person istravelling out of Malaysia and out of the Insured Person’scountry of origin. NOTE: Double Indemnity is applicable for either (i) or (ii) above,and not both.

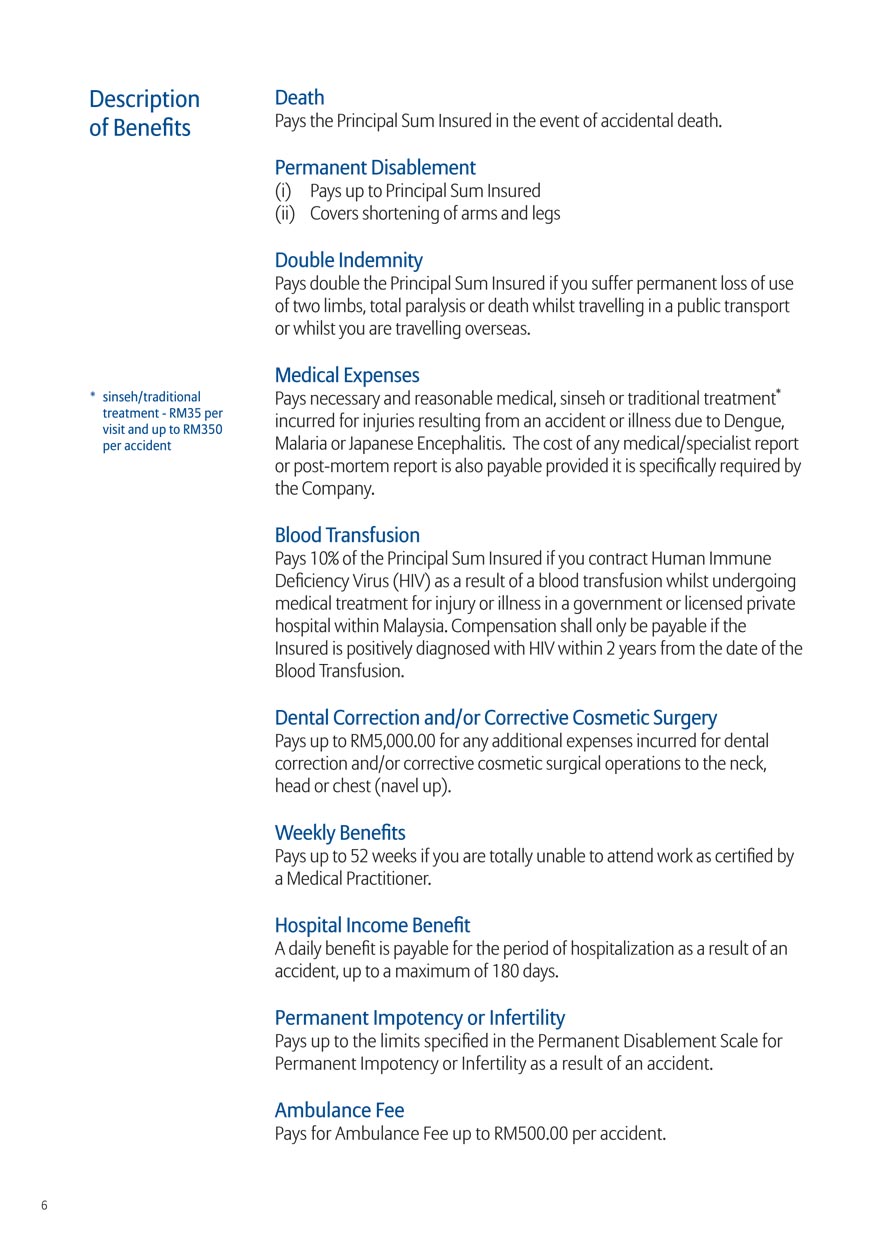

D. Medical Expenses The Company will indemnify the Insured Person for medical expenses incurred by the Insured Person as a result of an Accident or if the medical expenses are incurred by the Insured Person asa result of the Insured Person having contracted Dengue, Malariaor Japanese Encephalitis provided that the maximum liability ofthe Company arising out of any one Accident/Disability shall notexceed the amount specified in the Schedule. Medical expensesshall include expenses incurred for Hospital (including Roomand Board), clinical, medical and surgical treatments, Sinsehor Traditional Treatments* and the cost for obtaining Medical/Specialist/Post-Mortem Reports. * Sinseh or Traditional Treatment - The Company will reimbursethe costs of Sinseh or Traditional Treatment including medicinesubject to the sub-limits specified in the Schedule incurred by the Insured Person as a result of an Accident. E. Blood Transfusion

The Company will pay the Insured Person 10% of the Principal Sum Insured specified in the Schedule if the Insured Person contracts Human Immunodeficiency Virus (HIV) as a result of a Blood Transfusion whilst the Insured Person is undergoing medical treatment for Injury or Illness in a Hospital within Malaysia. F. Dental Correction Or Corrective Cosmetic Surgery

The Company will reimburse the Insured Person up to the amount specified in the Schedule in respect of the expenses incurred by the Insured Person for dental correction or corrective cosmetic surgery performed on the Insured Person’s neck, head or chest (navel up) following injuries sustained as a result of an Accident, provided: (i) such dental correction and/or corrective cosmetic surgery is recommended by a licensed orthodontist or cosmetic surgeon; (ii) such dental correction and/or corrective cosmetic surgery is performed by a licensed orthodontist or cosmetic surgeon. G. Hospital Income Benefit

In the event the Insured Person requires Hospitalisation as a result of an Accident the Company will pay the Insured Person a daily benefit as specified in the Schedule for the period of Hospitalisation, up to a maximum of one hundred and eighty (180) days. This benefit is triggered only if the Insured Person is Hospitalised for more than twelve (12) hours due to an Accident.

The above benefit is not applicable to food and drink poisoning,Dengue, Malaria, Japanese Encephalitis or Chikungunya and any other form of diseases. H. Weekly Benefits

If the Insured Person is temporarily unable to engage in or attend to the Insured Person’s profession or occupation due to Injury caused by an Accident covered under this Policy as certified by a Medical Practitioner, the Company will pay the Insured Person the amount specified under Weekly Benefits as provided in the Schedule up to a period of fifty two (52) weeks, effective from the date of confirmation of such temporary disablement by a Medical Practitioner. The benefits herein are payable to the Insured Person provided that the Insured Person has not made any claims under item B (Permanent Disablement) of Part 3 – Scale of Benefits. The above benefit is not applicable to food and drink poisoning,Dengue, Malaria, Japanese Encephalitis or Chikungunya and any other form of diseases. I. Permanent Impotency or Infertility

The Company will pay the Insured Person up to the limits specified in the Scale of Benefits if the Insured Person suffers Impotency or Infertility due to an Accident. Such Permanent Disablement must be certified by a Medical Practitioner. J. Kidnap Benefit

The Company will pay a lump sum of RM5,000.00 for necessaryexpenses incurred by the Insured Person’s family to recoverthe Insured Person and also offer a reward of RM25,000.00 forinformation leading to the recovery of the Insured Person providedthat the Insured Person is alive at the time of recovery. The paymentof this benefit is subject only upon verification and confirmation bythe police that a ransom has been demanded by the kidnappers forthe return of the Insured Person. Where no demand of ransom hasbeen made, the Company has absolute discretion whether or not tomake any payment under this benefit.

The Principal Sum Insuredwill be paid in full if the kidnapped Insured Person is not recoveredafter a period of one (1) year from the date of the kidnap.

K. Ambulance Fee

The Company will reimburse the charges incurred for necessaryambulance services rendered in Malaysia (inclusive of attendants)to and/or from the Hospital up to the amount specified in theSchedule provided such Ambulance Fee were incurred as a resultof an Accident to the Insured Person. The above benefit is not applicable to food and drink poisoning,Dengue, Malaria, Japanese Encephalitis or Chikungunya and anyother form of diseases. L. Funeral Expenses

The Company will pay the Insured Person’s legal personalrepresentative the amount specified in the Schedule as FuneralExpenses in the event of accidental death of the Insured Person. The above benefit is not applicable to food and drink poisoning,Dengue, Malaria, Japanese Encephalitis or Chikungunya and anyother form of diseases. M. Bereavement Allowance

In the event of the Insured Person’s death due to Dengue, Malaria,Japanese Encephalitis or Chikungunya, the Company will pay to theInsured Person’s legal personal representative, 10% of the PrincipalSum Insured specified in the Schedule as a Bereavement Allowanceupon submission of the required documents. N. Personal Liability

The Company will indemnify the Insured Person up to the amountspecified in the Schedule if the Insured Person shall become legallyliable to pay to third parties in respect of accidental bodily Injury or accidental damage to property. The territorial limit of this benefitis within Malaysia only. In the event that any claim is proven to befraudulent after payment is made, the Company will retrieve allpayments made in respect of that fraudulent claim.

The Companyfurther reserves the right to take any further action, including legalaction against the claimant in such case.

O. Renewal Bonus

Subject to the provisions of this Policy, Renewal Bonus shall be paidto the Insured Person or the Insured Person’s legal representativeas the case maybe, in addition to the payment of the Principal SumInsured or such part thereof payable in respect of a claim madeunder this Policy. In the event of a claim having been made underBenefits B (Permanent Disablement) or C (Double Indemnity) ofthis Policy, any accumulated Renewal Bonus will be forfeited andcomputations for future Renewal Bonus will begin a new from thenext renewal date of this Policy.

Renewal Bonus shall not be applicable under Benefits E(Blood Transfusion), I (Permanent Impotency or Infertility), M(Bereavement Allowance) and N (Personal Liability).

P. Prostheses/Wheelchair

In the event the Insured Person suffers Permanent Disablement due to an Accident, the Company shall reimburse the Insured Person, up to the limits stipulated in the Schedule, the actual costs of purchasing any of the following medical equipment provided always that such medical equipment are necessary to assist in the mobility of the Insured Person and are recommended by the attending Medical Practitioner: (i) wheelchair; (ii) artificial arm or leg; and/or (iii) crutches. Q. Repatriation Expenses

The Company will reimburse the Insured Person’s legal personalrepresentative up to a maximum of RM10,000.00 for Repatriation Expenses incurred in sending the Insured Person’s mortal remains back to the Insured Person’s Home country if the Insured Person’sdeath is due to an Accident whilst travelling outside the InsuredPerson’s Home country. The reimbursement of Repatriation Expenses shall be based on theactual expenses incurred or RM10,000.00 whichever is lower, for thetransportation of the Insured

R. Miscarriage Due To Motor Vehicle Accident

The Company will reimburse the Insured Person up to RM1,000.00per person per Accident in the event the Insured Person suffers amiscarriage as a result of a motor vehicle Accident, whether as a pedestrian, passenger, pillion or driver/rider. S. Compassionate Care

The Company will reimburse the Insured Person up to RM5,000.00for reasonable expenses incurred in travelling and accommodationby one (1) Family Member to take care and/or accompany the Insured Person who is a minor, not more than twelve (12) years old,during the period of Hospitalization, provided the Hospitalizationis a result of an Accident. The above benefit is not applicable to food and drink poisoning,Dengue, Malaria, Japanese ncephalitis or Chikungunya and anyother form of diseases.

T. Snatch Theft

In the event of loss or damage to the Insured Person’s PersonalEffects due to snatch theft, the Company will compensate up toRM300.00 subject to a police report being lodged. The reimbursable items are replacement fee for NRIC, passport, driver’s licence,credit/charge cards, access cards for entry to buildings/parkinglots, eye glasses, hand phone, wallets and purses. Police report to be made within twenty four (24) hours of occurrence. U. Cashless Hospital Admission and Discharge Benefit

In the event the Insured Person requires Hospitalisation due to Accident, the Company will facilitate the Insured Person’s admission into a participating Hospital in Malaysia or within the Asia Pacific Countries by providing any guarantee required by the Hospital up to a maximum of RM2,500.00. Thereafter, the Company will also facilitate the Insured Person’s discharge from the same Hospital provided: (i) the final bill from the Hospital does not exceed the Insured Person’s Medical Expenses Benefit stated in the Schedule ofthis Policy; (ii) all items in the final bill from the Hospital are in fact covered under the Medical Expenses Benefit as defined in this Policy. Items that are not covered will have to be borne by the InsuredPerson. This Cashless Benefit will only be activated after seven (7) working days from the submission and acceptance of the Insured Person’s proposal to any registered office of the Company. Food and drink poisoning, Dengue, Malaria, Japanese Encephalitis, Chikungunya and other form of diseases are excluded from the Cashless Admission. Part 6 − Additional Benefits

Subject to the terms, exclusions, provisos and conditions contained in this Policy, the cover as provided under this Policy shall be extended to the circumstances provided hereinafter: 1. PA-CL003 – Motorcycling Risk Motorcycling (whether as rider or pillion) for private or business purposes, provided always that the Company shall not be liable for any claim arising out of racing, pace making or participation of the Insured Person in any speed contests reliability or other trials. 2. PA-CL004 – Strike, Riot and Civil Commotion Labour disturbances, riots or civil commotions or any persons of malicious intent acting on behalf of or in connection with any political organization, provided always that this extension shall not apply whilst the Insured Person is taking part in any disturbance of public peace. 3. PA-CL005 - Hijacking Unlawful seizure or wrongful exercise of control of an aircraft vessel or public conveyance. 4. PA-CL006 – Unprovoked Murder and Assault Unprovoked murder or assault. 5. PA-CL010 – Suffocation Through Smoke, Fumes and Poisonous Gas Suffocation through smoke, fumes and poisonous gas. 6. PA-CL011 – Hunting and Mountaineering Hunting (except big game hunting) and mountaineering (withoutuse of ropes or guides) for leisure purposes only. 7. PA-CL014 – Intoxication by Drugs or AlcoholIntoxication by drugs or alcohol. For this purpose all such drugsmust be prescribed by a qualified registered medical practitioner. 8. PA-CL016 – Amateur Sports (except martial arts and boxing) Indoor or outdoor sport as an amateur, except martial arts and boxing. 9. PA-CL024 – Flood, Windstorm and Earthquake Flood, hurricane, cyclone, typhoon, windstorm, earthquake,volcanic eruption or other convulsion of nature.

10. PA-CL063 – Poisonous Food or Drink Food or drink poisoning.

11. PA-CL064 – Water Sports Water sports activities: Water skiing, yachting, surfing and snorkeling as an amateur. 12. PA-CL065 – Underwater Activities/Scuba Diving (Up To 50 Metres)Underwater activities involving the use of breathing apparatus/scuba diving (up to 50 metres). 13. PA-CL066 – Polo Playing and Bungee Jumping Polo playing and bungee jumping as an amateur. 14. PA-CL078 – Accidental Drowning or Near Drowning Accidental drowning or accidental near drowning. 15. PA-CL080 – Insect, Snake and Animal Bites Harmful insect, snake and animal bites excluding diseases or illness caused by parasite, bacteria or viruses carried by insects such as mosquitoes and the like, snake or animal. Allianz Malaysia

Allianz Malaysia takes pride in being part of the notable Allianz Group which was founded in 1890 in Germany. With approximately 142,000 employees worldwide, the Allianz Group serves more than 78 million customers in about 70 countries.

Allianz officially stepped foot in Malaysia in 2001 when it became the controlling shareholder of Allianz General Insurance Malaysia Berhad ("AGIM”). In 2007, the general insurance business of AGIM was transferred to its wholly-owned subsidiary, AGIC. Following the completion of the transfer of general insurance business, AGIM changed its name to AMB and became an investment holding company, with a general insurance (AGIC) and life insurance (ALIM) subsidiary. AGIC is one the leading general insurer in Malaysia and has a broad spectrum of services in personal lines; small to medium enterprise business and large industrial risks. AGIC also leverages on the banc assurance agreement with CIMB Bank to reach out to the bank's over-a-million-customer base. The GWP for general insurance business for financial year 2011 reached a mark of RM 1.46 billion. ALIM offers a comprehensive range of life and health insurance and investment-linked products and for the financial year 2011, ALIM recorded a gross written premium ("GWP”) of RM 1.14 billion and is one of the fastest growing life insurers in Malaysia. Allianz Malaysia aims to distinguish itself as the most trusted provider of financial services to suit the lifetime needs of Malaysians. The Company sees the importance of sustainable growth through global diversification, the reduction of complexity, value-based management approach, and crucially important employees, ultimately attaining customer satisfaction.

Malaysia Medical Insurance Organization (MMI)

Your Trusted and Experience Malaysia Largest Risk Management Medical and Health Insurance Solution Advisory Organization.

Malaysia Medical Insurance Organization (MMI) Head Office,

Your Trusted Malaysia Largest Medical Insurance Advisory Organization 158-3-7, BLOK 158, KOMPLEKS MALURI,

JALAN JEJAKA, TAMAN MALURI,CHERAS, 55100 KUALA LUMPUR, MALAYSIA.

MMI careline +603-92863323

mmicare@medicalinsurance.com.my

www.medicalinsurance.com.my

| |||||||||||||||

| |||||||||||||||

| Allianz Shield Personal Accident Insurance-Allianz Shield Personal Accident Insurance | |||||||||||||||

| Product Reviews: [Add Review] | |||||||||||||||

Back

Back